- NQrack 💉💉💉

- Posts

- 2025.03.12 -- In balance, inflation rate news on deck this morning

2025.03.12 -- In balance, inflation rate news on deck this morning

we're in balance, but the news will usually. move the tape..

I’m working on a glossary of the concepts here, if you want to follow along, I’ll have it up in the next day or two! See the end of this email for additional information on how you can get up to speed and really learn how to read these markets.

Overview

We’re still in a big down trend, having all but given up all the gains from the election night pump in November, and then some. we’re below all the moving averages on the daily chart, and a bit below the last volume level since November’s election pump.

Not much happened yesterday, and we remain in balance from the Monday drop…

So basically the plot is the same as yesterday…mildly bullish-ish if they can stay above yesterday’s Value Area High, with increasing levels of bullishness getting above last week’s levels above. As of now, they haven’t even gotten close to last week’s value area at all.

What we do know: Inflation rate at 8:30am, they often like to trade up into events, and we know that during and after the event they can goose it or dump it. And those of us in the know know that the outcome of the news doesn’t matter to a day timeframe trader, but the price movement itself does.

Of note…

Yesterday, we bounced at the 50% mark between yesterday’s Value Area Low and 2024 Point of control. Nothing to say about this, but something of note, to be aware of, as midpoints are often reversal points, and they certainly reversed it in the afternoon with that one, although they didn’t make it terribly far.

Overall, they still haven’t made it to 2024 POC. They can. Not saying they will, but they often stop short, then finally finish the job when you’re not expecting it. So I want to make sure you’re not surprised if they do, and be ready. Especially on days where there’s plenty of excuses to be volatile (which is today, tomorrow, and to a lesser degree Friday).

Key Trading events

3/12/2025, 8:30:00 AM | US | Core Inflation Rate YoY |

3/12/2025, 8:30:00 AM | US | Core Inflation Rate MoM |

3/12/2025, 8:30:00 AM | US | Inflation Rate YoY |

3/12/2025, 8:30:00 AM | US | Inflation Rate MoM |

3/13/2025, 8:30:00 AM | US | PPI MoM |

3/14/2025, 10:00:00 AM | US | Michigan Consumer Sentiment Prel |

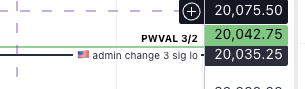

In summary, I’m looking long if they can get past yesterdays spike, and start moving fast towards last week’s 3 sig low, but don’t trust any of the bullish moves fully until past 2 sigma low of the previous week. We are still in a downtrend, and rips are being sold. So firstly i’m looking for a failure of yesterday’s Value Area High, and if they decide to take a trip up, I’m looking for rejections along the way to 3 sig, 2 sig, and previous week’s Value Area Low, which coincides with the previously mentioned 99% edge of the election pump zone:

Learn More

I started this jounrey over 3 years ago. Much of the terminology, and IMO amazing content can be from where I learned it: https://www.youtube.com/@Catching_Rockets

and here is one of the most valuable classes anyone wishing to understand the “basics” of the market at a fundamental level:

https://www.youtube.com/watch?v=_ecYIk82-TY

This isn’t a paid, or even solicited endorsement. I am passing on this knowledge to anyone who is a curious sort, and want to get quality information amongst a sea of “get rich quick” dross.

Here’s to patience, confidence, and learning!