- NQrack 💉💉💉

- Posts

- 2025.03.19 - Bullish-ish-ish this morning, can we get follow through?

2025.03.19 - Bullish-ish-ish this morning, can we get follow through?

FOMC this afternoon could goose it or drop it like its hot

Preamble, glossary updates…an interview from an AI

Before we start, i want to show a perfect scalp, just because it felt great🤭. Already scaled out two contracts, about to trail this one, because you never know if she’s gonna lose it:

[update, made an error even as I was bringing in the screenshot and closed early on accident 🤣😭]

I’ve updated the glossary with a few more terms I’ve caught myself going on about:

https://markets.jonmadison.com/posts/trading_glossary/

Feel free to hit me up if you have any more that you need clarity on!

After my analysis yesterday, I wanted to do some confirmation on what I saw with the rejection, and Claude ended up essentially interviewing me! I’m in the process of writing some transcription software, and was hoping to give you an audio version, but I’m still working out the kinks. If you are ever interested, Here’s our conversation…we talk about the move itself, but then it starts asking me about the newsletter, and I found it fun to talk about why I’m doing this.

https://claude.ai/share/30522856-4e93-4a76-84d6-4fe9656c2ad9

While the beginning was interesting to me, at least, the interview starts when Claude asks “Was this shared as part of a trading community or group where you provide such signals?” :)

Market Summary

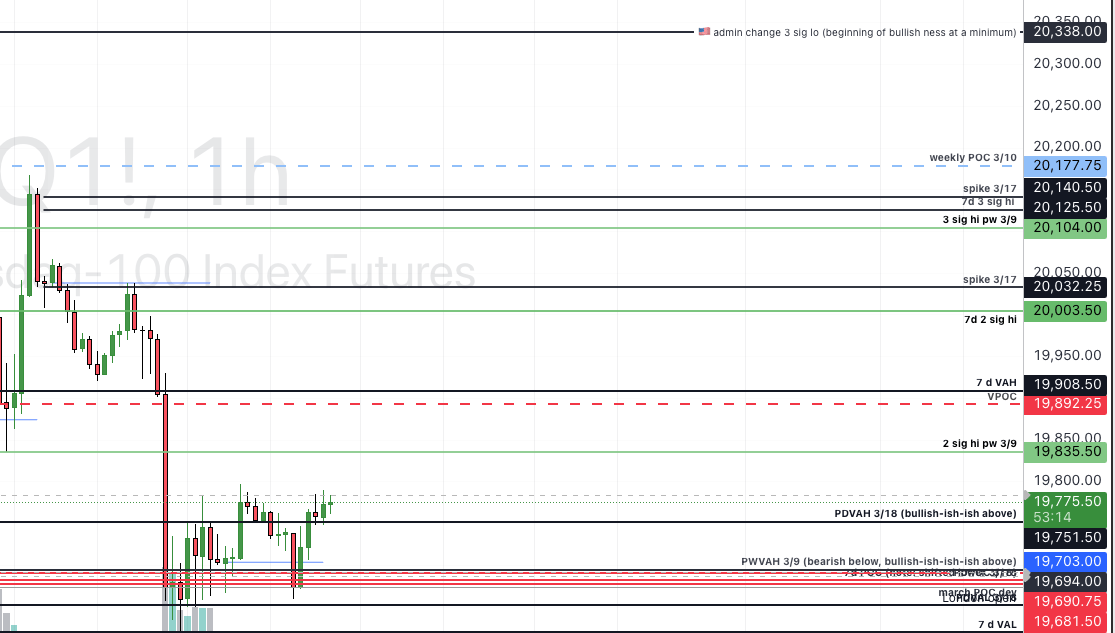

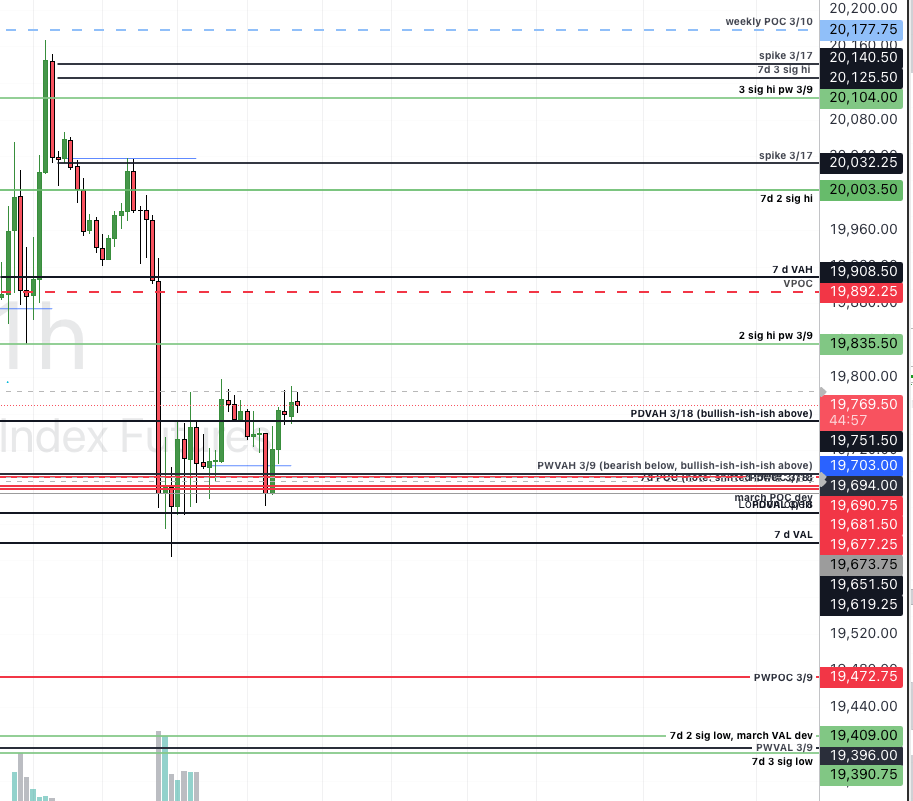

I won’t even bore us with the big picture chart from yesterday…and the day before…and the day before…we’re in the same spot. Yesterday they proved that they were not ready for the breakout,a nd that we’re still within the same range for now. So far the new buying has been met with selling. But it could just be a shakeout until they start to push higher, so be aware. That point where I made the trade? that exacting level? It’s yesterday’s PDVAH. from a purely technical perspective, the day is bullish if they stay above.

and as far as getting some sort of a rally, it’s only bull-ish-ish (the more “ish”s, the less bullish it really is 🙂 )

We have a ways to go before we’re out of this range, but it’s something that. can easily happen in one day. to see the scale, at a minimum, we need that top number, at 20338, for me to even consider this market to be bullish again.

Close candles above the 2024 VAH, and it may be time for me to look into heavier positions in index funds. All of that said, I’m not saying now is not a good time. It’s just that we seem to have some unfinished business below to address before we are out of the woods (i keep yapping about that 2024 POC below that we still haven’t hit, but I could be wrong. 🤷🏾♂️)

Plan for today? We might be watching paint dry, or watching turtles watching paint dry, until FOMC, or we could see some FOMO pressure up into FOMC, but I’m interested in what the interest rate decision at 2p EST, then Jerry’s lil talk at 2:30p bring to the market. So far, nothing has been able to move them out of the balance of last week, so we’ll see. In the meantime, if she loses PDVAH we always go for an 80% attempt down to the POC for a trim, and try to ride it back down to PDVAL (while recognizing that there is a lot of stuff around the POC to allow it to be defended). and if she’s aggressive, see if we can get a trip to the 7 d VAL and below. Otherwise, maybe we’ll get another attempt to break out of the range on the upside, expecting some magnetism at the VPOC from yesterday, and turbulence as well starting in that area. At face. value, there’s less resistance up then there is down, but anything can happen. Especially on Jerry Day.

Hopefully this has been helpful, feel free to reach out with any questions, and here’s to learning, confidence, and profits!