- NQrack 💉💉💉

- Posts

- 2025-06-01 -- BACK -- caught you lookin for the same thing

2025-06-01 -- BACK -- caught you lookin for the same thing

do it. we're still looking for longs, until we're not. but with caveat.

🌟 Took a quick break, big picture summary

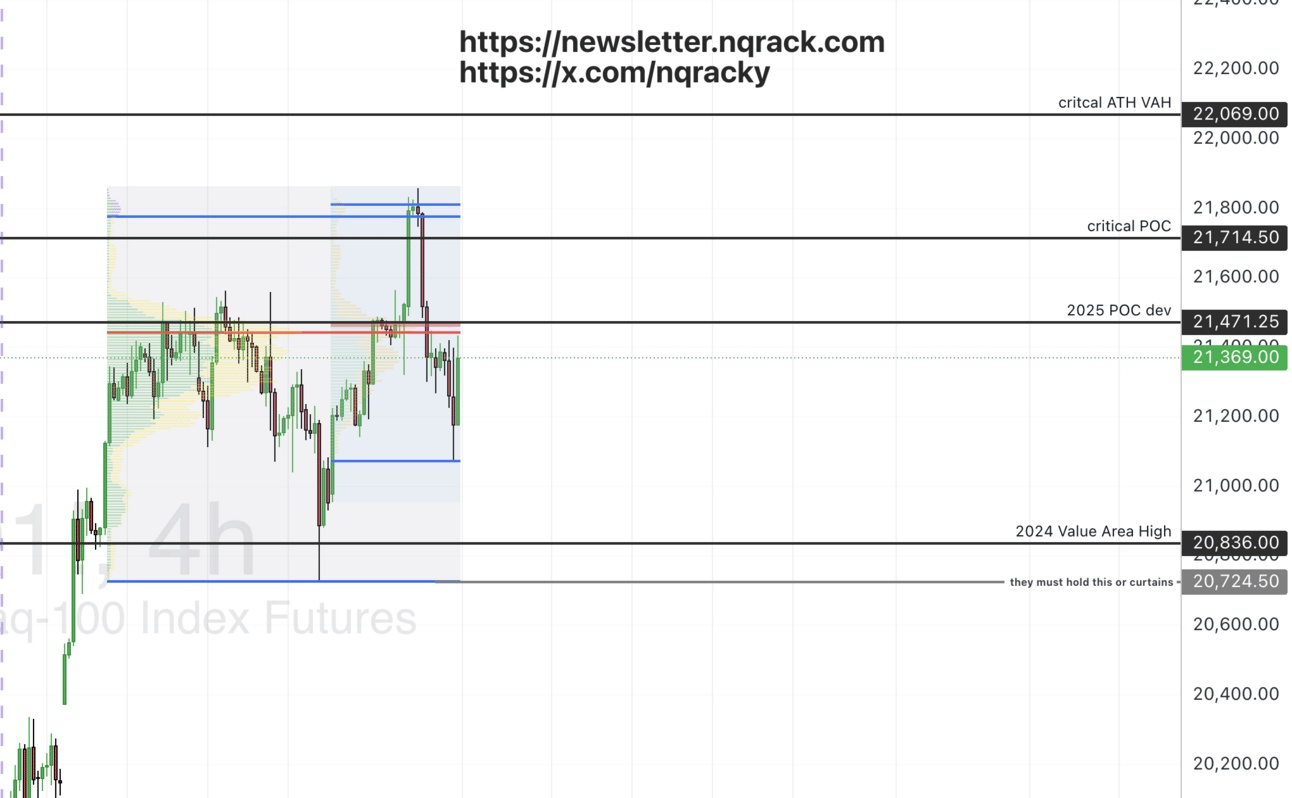

Decided to take the Memorial Day week off of the newsletter, well, just because. The kids are out of school; we’re adjusting to new schedules, I hadn’t been getting up as early (but need to). So let’s go! The market is the market. we are still trying to push up as much as possible, disaster has not struck yet. As long as we’re above the 2024 Value Area High, we’re not killing the tape just yet. BUT, we’re in the middle of the year already and 2025 has not started to make its own numbers, really. Currently, we are looking at nearly an inside year, if she can’t break out, “soon”.

🔢 The Numbers

Above 21464 will need to be recaptured to test the next major number in the sequence, 21513. Next up, is 21711, seeing if she can break past the harsh overnight rejection area, to 21857.25. above that, June will finally start making its own numbers, and we continue the trek to the former all time highs. 21979 this week will be significant for the bulls, and closing above this, is almost certain to give us new all time highs, sooner or later, barring any strange news. | Below they keep pounding below 21238.5, and attempting to rescue it. if they can’t hold this, we’re going to need to seek down lower, say, to retest that strong rejection upwards of 21072.25 (right on the nose), 21062.25, 20958. This week, bulls really don’t want to see us lose 20714.75. |

📸 The Big Picture

I’ve kinda given my big picture view already above. We are in a balance, with a slightly different latter balance if you want to count it. My plan is to take the full balance, look for opportunities on each edge and consider them entries or ultimate targets (always shaving at the POC), until we see otherwise. Now, that could happen right at the start of the week, and if so, you see my numbers above, and below.

I mentioned before I took my hiatus that we could chop for quite awhile, so I wouldn’t be surprised one way or another if they chop, but currently, chopping higher, has been the overall move. We’ll take it day by day, and here is my more detailed chart for the week, changing daily…

📰 News

Quite a bit of news this week of the market moving variety, so we could go wherever they wan to take it. Should be useful.

Date | Time | Description |

|---|---|---|

6/2/2025 | 10:00:00 AM | US ISM Manufacturing PMI |

6/3/2025 | 10:00:00 AM | US JOLTs Job Openings |

6/4/2025 | 10:00:00 AM | US ISM Services PMI |

6/6/2025 | 8:30:00 AM | US Unemployment Rate |

6/6/2025 | 8:30:00 AM | US Non Farm Payrolls |

I’ll be tweeting as i get time, of course, but remember: be a sniper, and remember as David Frost always said…this is a morning business….no need to hand around the store all day.

Here’s to patience, learning, and profits!