- NQrack 💉💉💉

- Posts

- 2025-06-11 Turnaround or more creepiness?

2025-06-11 Turnaround or more creepiness?

🌟 Welcome!

🔢 The Numbers

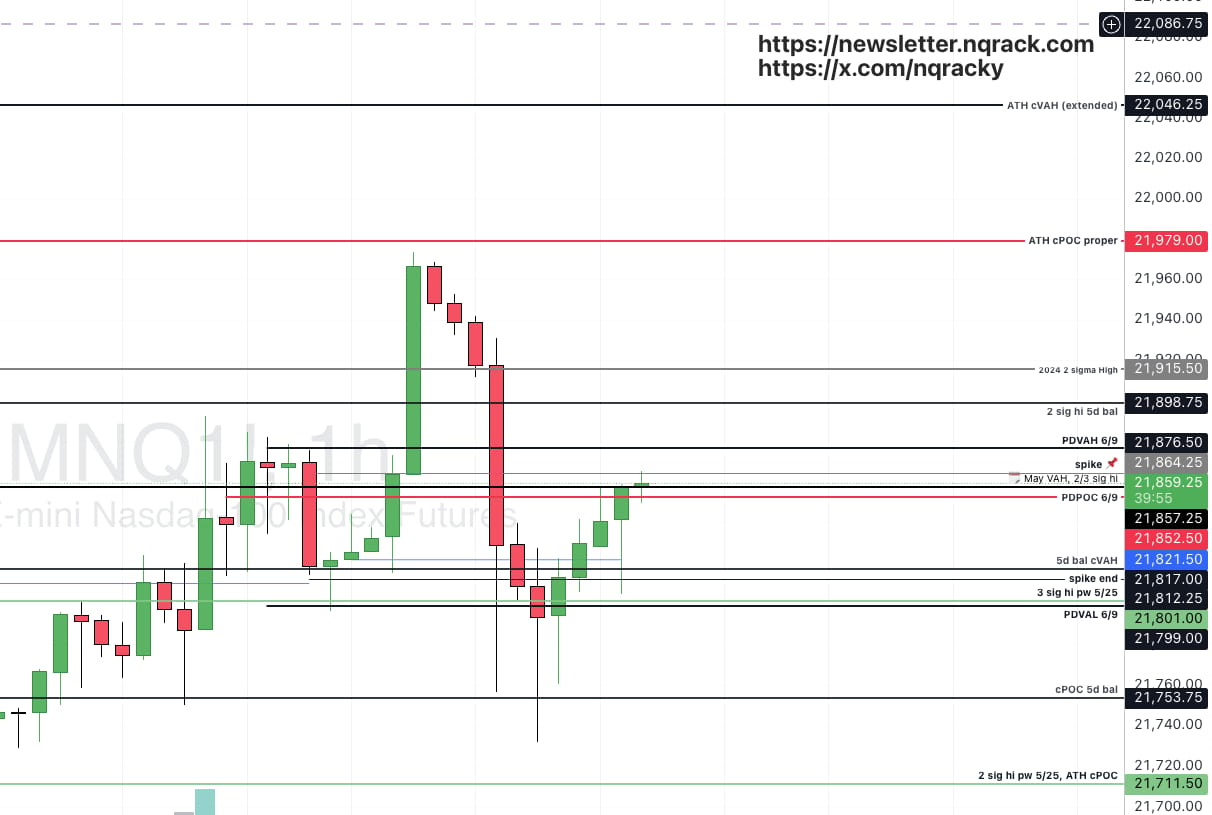

Above getting started, let’s see ourselves above 21864.25 on our way to 21876.5. Then, recapturing the overnight pumper will need us to start reclaiming 21898.75, 21915.5, and, if they’re good, reaching the target they were fake looking for last evening at 21979, and above. | Below losing 21817 during the session, and not recovering, is letting us know they want to retest the overnight lows (what a range in the evening!) 21753.75, and potentially 21711.5, and, the last level of support before some danger zone for bulls, 21665.25. |

📸 The Big Picture

They are still creeping, closing daily within 1% either way. On the daily (and weekly, not pictured), it appears as if she’s either putting in a lower high, today, after last evening’s sell off, or, trying to fully recapture late february’s dump candle. Given the price action, it certainly seems the latter.

|  |

My take: barring any news, she’s still continuing to. creep upwards, carefully, with lots of tripping. downward along the way. She’s got to at least make it out of yesterday’s spike $MNQ_F ( 0.0% ) 21864.25 for the day, or we’ll be seeing downside for the day, with 21817 and 21799 as potential levels of defense.

They’ve painted enough of a tape overnight to still play around heavy for day time frame traders, and still close relatively flat on the day. I’ve got my levels, won’t be initiating from POCs, but using as a target when applicable. There’s a May VAH on the tape that can also be used as a pivot to some degree, but you’ll have to set your stops accordingly

📰 News

No official news today, but anything can happen, stay aware.

Here’s to patience, learning, and profits! 🫡