- NQrack 💉💉💉

- Posts

- 2025.06.29 what i'm looking at this week

2025.06.29 what i'm looking at this week

🌟 Welcome!

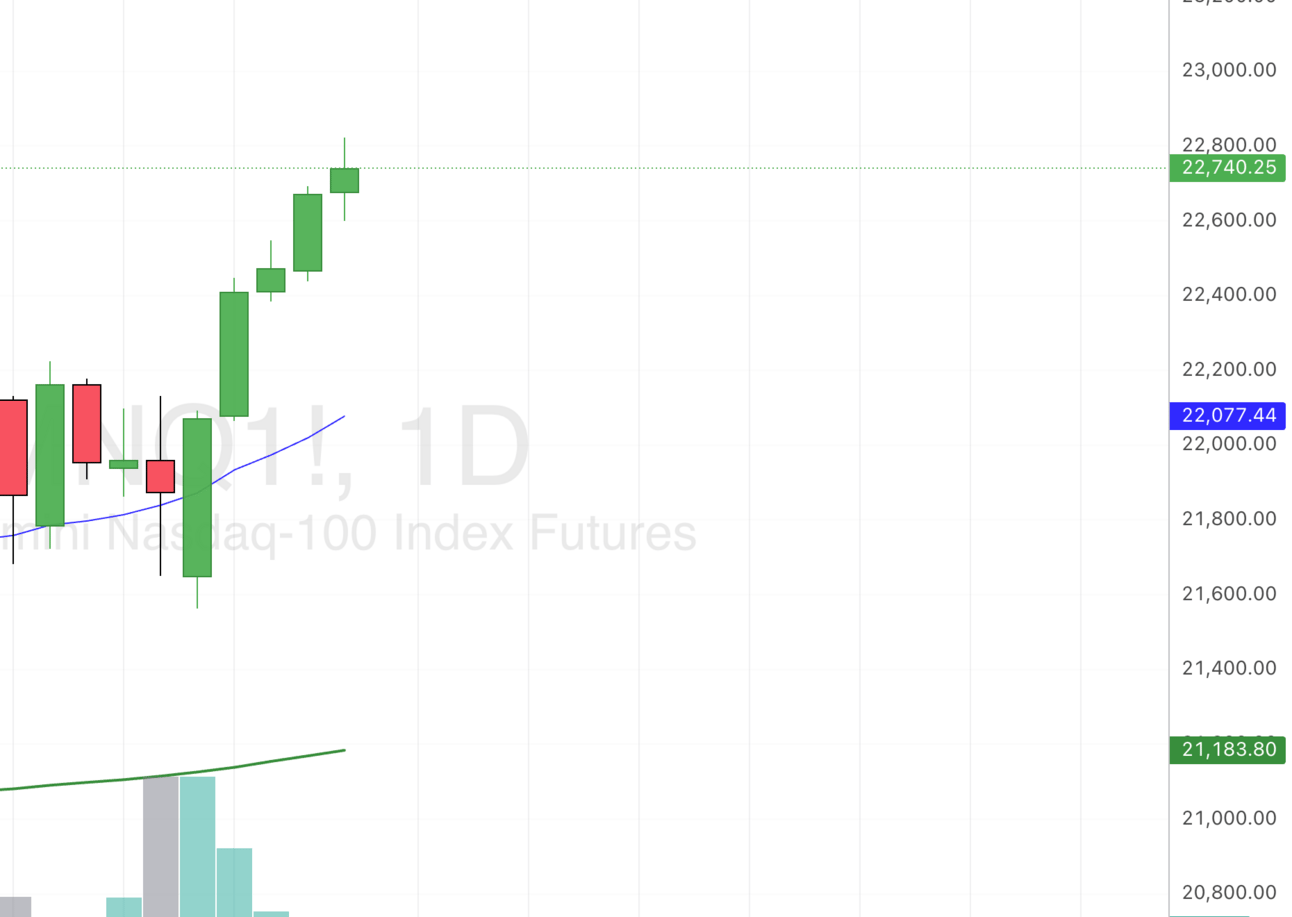

📸 The Big Picture

Above the moving averages the trend is your friend. On its face, it’s bullish.

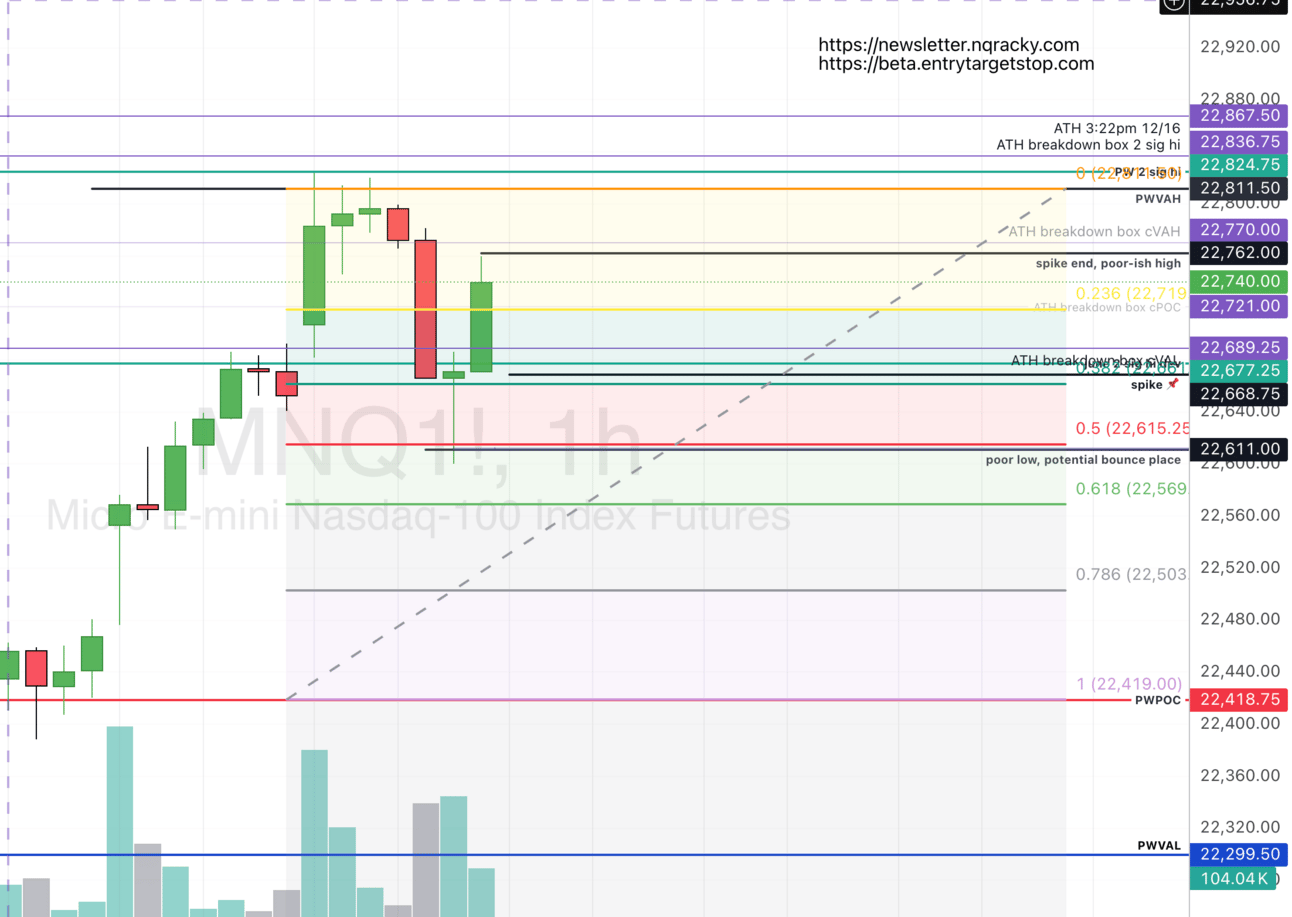

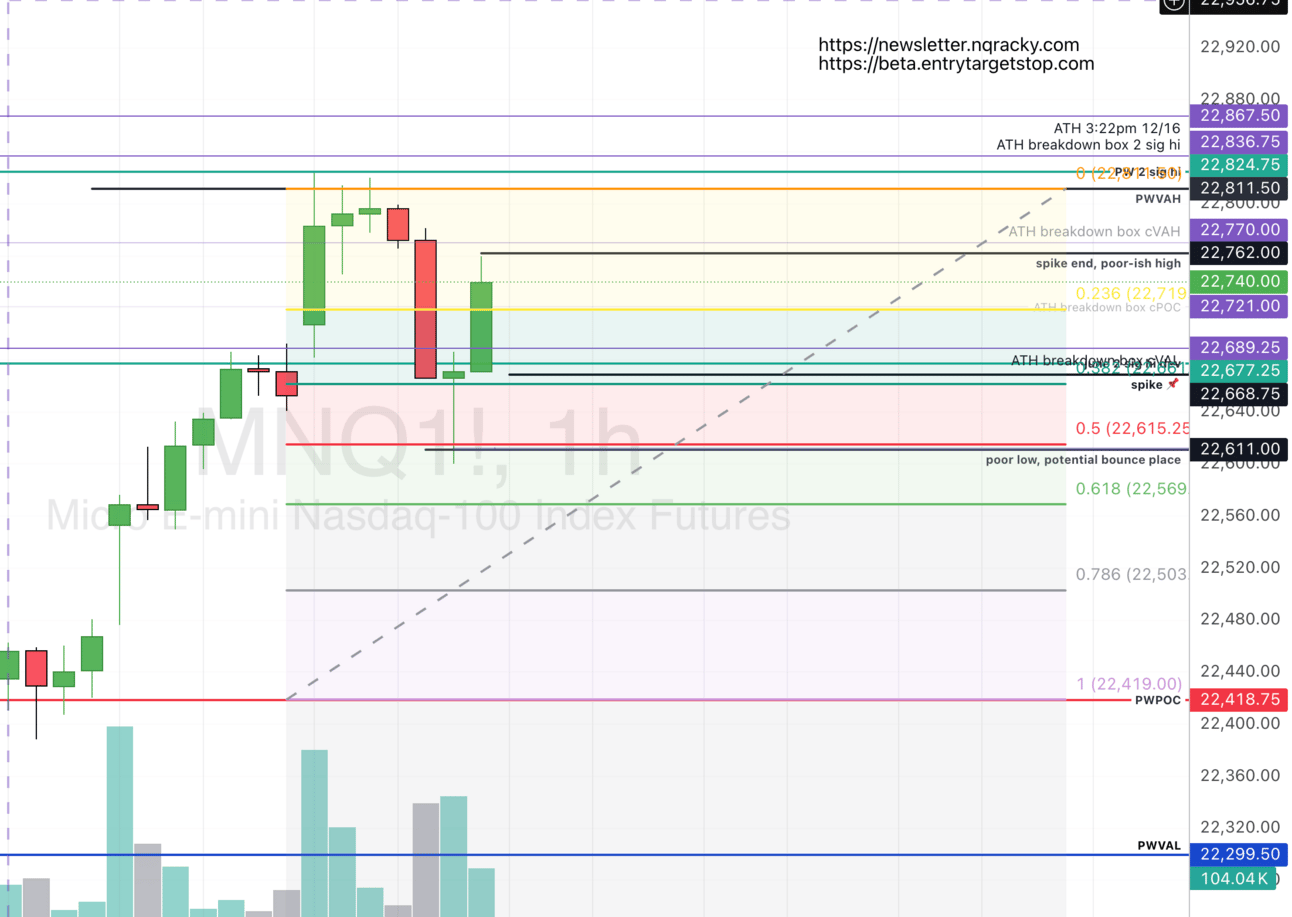

Let’s zoom in, for the beginning of the week. Fibs check out.

The Fibonnaci from PWVAL to PWVAH lands our halfback/50% right at a poor low. I marked this poor low before I did the fibs, which makes for a decent confirmation.

given its exacting level

given it’s crowded low (i.e. may indicate trapped shorts)

We can make an assumption that we’re dealing with primarily retail involvement. How does that affect the tape? I cant ‘say how much; it’s an awareness we can use to gague how we want to play this retail laden tape.

In general, the market is bullish. The trend is your friend. There is a critical poor low that has a high probability to be revisited (that halfback mentioned above). For me, this will determine my ultimate outlook on the week. They could pretend to take it out resulting in a spike (not uncommon), or immediately bounce back for some nice short covering to start the week. Defending this heartily will see us likely taking out the ultimate ATH on the tape, and seek higher numbers.

The market open for the week will be important to watch, but of course won't tell the whole story. We saw last week the gap down, and amazing recovery by the end of the week. For me, all lows are pullback opportunities for longs, until we lose previous week's Value Area Low.

📰 News

Date | Time | Description |

|---|---|---|

7/1/2025 | 10:00:00 AM | US ISM Manufacturing PMI |

7/1/2025 | 10:00:00 AM | US JOLTs Job Openings |

7/3/2025 | 8:30:00 AM | US Unemployment Rate |

7/3/2025 | 8:30:00 AM | US Non Farm Payrolls |

7/3/2025 | 10:00:00 AM | US ISM Services PMI |

Here’s to patience, learning, and profits!