- NQrack 💉💉💉

- Posts

- 2025.07.13 what i'm looking at this week

2025.07.13 what i'm looking at this week

news upon news

🌟 Welcome!

After pushing the market up July 4th weekend, the move has proven itself to be unproven as of yet, and we are in a balance. The market can go either way, if they don’t decide to try to waffle for another week. We have a load of news this week, so I do expect some definitive movement one way or another, but anything can happen.

📸 The Big Picture

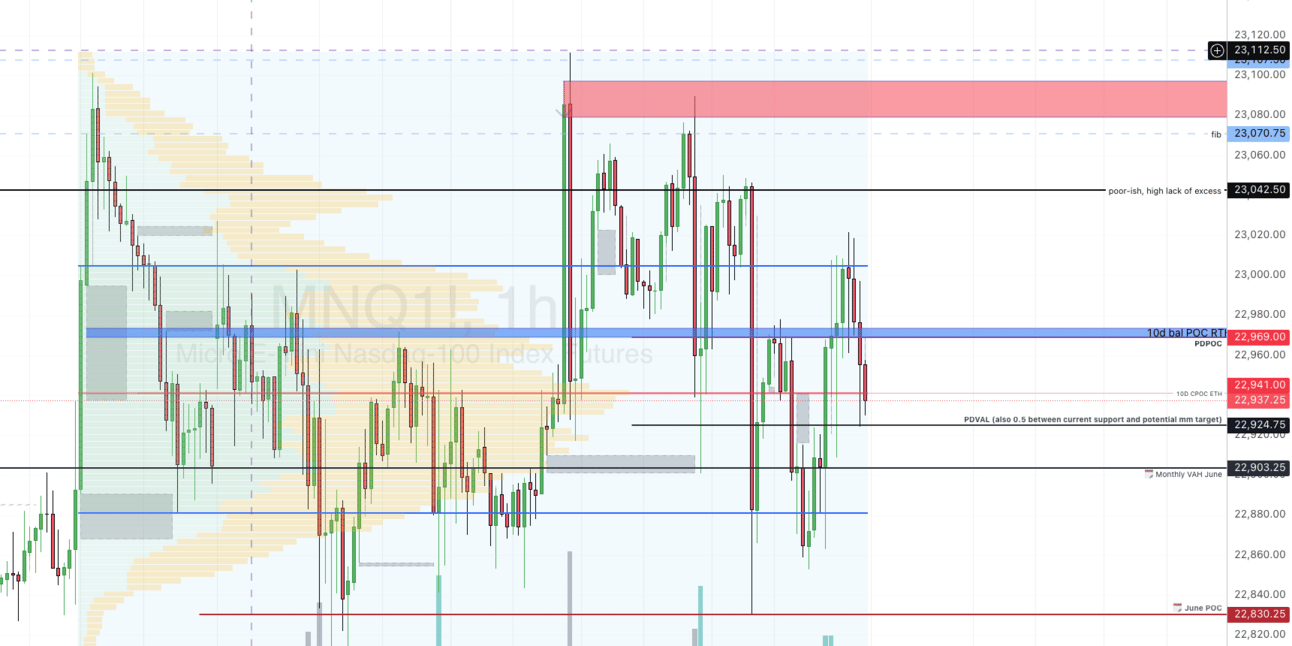

We are still bullish, looking for higher numbers, or, consolidating for a liquidation event. We are currently in a balance, and here is our 10 day balance:

TLDR:

i'm neutral-bearish, while understanding that they can push it higher just fine right now, given their position.

Given my focus is daily, i’m using the balance as my barometer to direct my intra day trades within the balance, with levels marked to signal opportunities for longs, shorts, or pullback entries accordingly.

general rule : closing candles above or below for 5/10/15 minutes has me interested in putting in a trade with a target for the next number, with a retest of the breakdown/up being the optimal entry. fade the edges (value are high, value area low), target the middle (POC). Add on when appropriate. Depending on the move, appropriate pull back entry tries are fair game.

Details:

We’re in a balance, ~10 days worth .

Looking at the tape both ways, I see more than a few possibilities, and here are my thoughts on each case.

Neutral:

I’m looking for the June POC 22830-00 area to be defended. If we continue up, I’m eyeing a rough patch around 23042.5, or at least an opportunity for a scalp downward as they retest that area. If they can knock it below the VAH of the balance area, then down to the 10d balance POC, even, then i’m holding as long as i can.

Given the potential volatility this week, i would give them as low as 22611-572 range before calling it quits for the bulls.

Bullish:

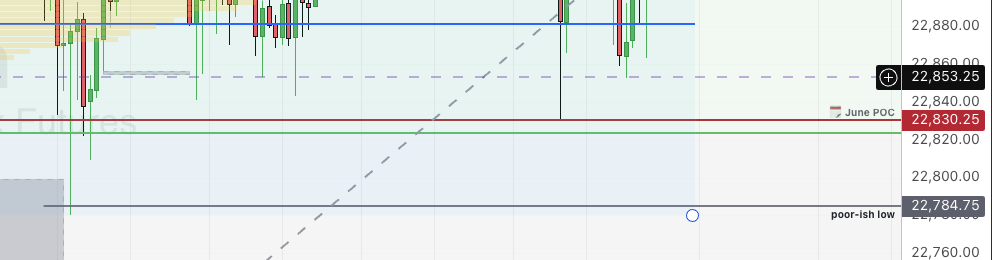

For the bullish case, i can see them actually first giving us a dip to the bottom of the balance area first, as low as as 22784.75 region or even below, see ahead. That said, watch for slowed tempo in that area, as they may plot a reversal.

If they drop below, then can recover above June POC (22830.25), then ultimately 22903.25, i’m banking on them going for new all time highs.

I calculated a measured move target early last week at 23228.5. I’m calling that number verified, as yesterday’s Value area low is just about at the 50% between my “longer term support” area at 22611.25, and the measured move target. In addition there’s another nice confluence at an earlier marked resistance level around 23083.

And, if i take a fib from a (still untouched) VPOC at 22572.0 to that measured move, the 50% is our June POC, 0.382 is Friday’s POC, the 0.236 is just shy of my resistance area marked on the chart, so i’m going to go with those as important places.

Bearish:

For the bearish case, standard issue. losing 22941, and we’ve lost the vwap 1st deviation, they’ll need to show strength or they’ll make it to retest 22903.25. The sequence is: 22903.25 → 22830.25 → 22784.75 → 22705 → 22677.25 → 22611 (ish). anything in between is no-man’s land.

📰 News

Lots of news on the docket, so many opportunities to move the tape before, or after (and sometimes during). You know they often like to move the market in a particular direction above the move so they can reverse it later, or, gain an advantage and a spot to go higher..you just gotta read the tape, check the context, and you’ll get an idea of which is which. But watch for the traps. Nobody knows, and anything can happen…but we have our numbers, our guideposts.

Date | Time | Description |

|---|---|---|

7/15/2025 | 8:30:00 AM | US Core Inflation Rate MoM |

7/15/2025 | 8:30:00 AM | US Inflation Rate MoM |

7/15/2025 | 8:30:00 AM | US Inflation Rate YoY |

7/15/2025 | 8:30:00 AM | US Core Inflation Rate YoY |

7/16/2025 | 8:30:00 AM | US PPI MoM |

7/17/2025 | 8:30:00 AM | US Retail Sales MoM |

7/18/2025 | 8:30:00 AM | US Housing Starts |

7/18/2025 | 8:30:00 AM | US Building Permits Prel |

7/18/2025 | 10:00:00 AM | US Michigan Consumer Sentiment Prel |

Here’s to patience, learning, and profits! 🫡🫡🫡