- NQrack 💉💉💉

- Posts

- 2025.07.28 -- monday's outlook for my week

2025.07.28 -- monday's outlook for my week

*lots* of news this week, don't get whiplash

🌟 Welcome!

What an interesting start to the week! Why? could it be tariffs? liquidity for this week’s moves? We’ll see!

🔢 The Numbers

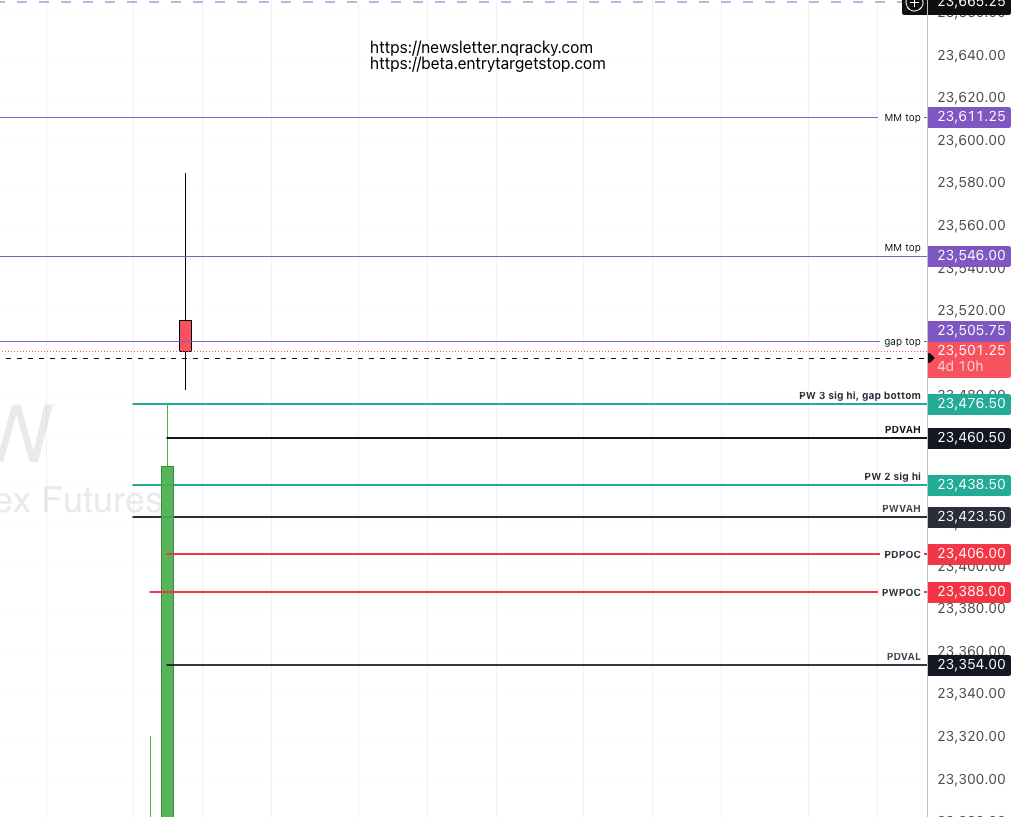

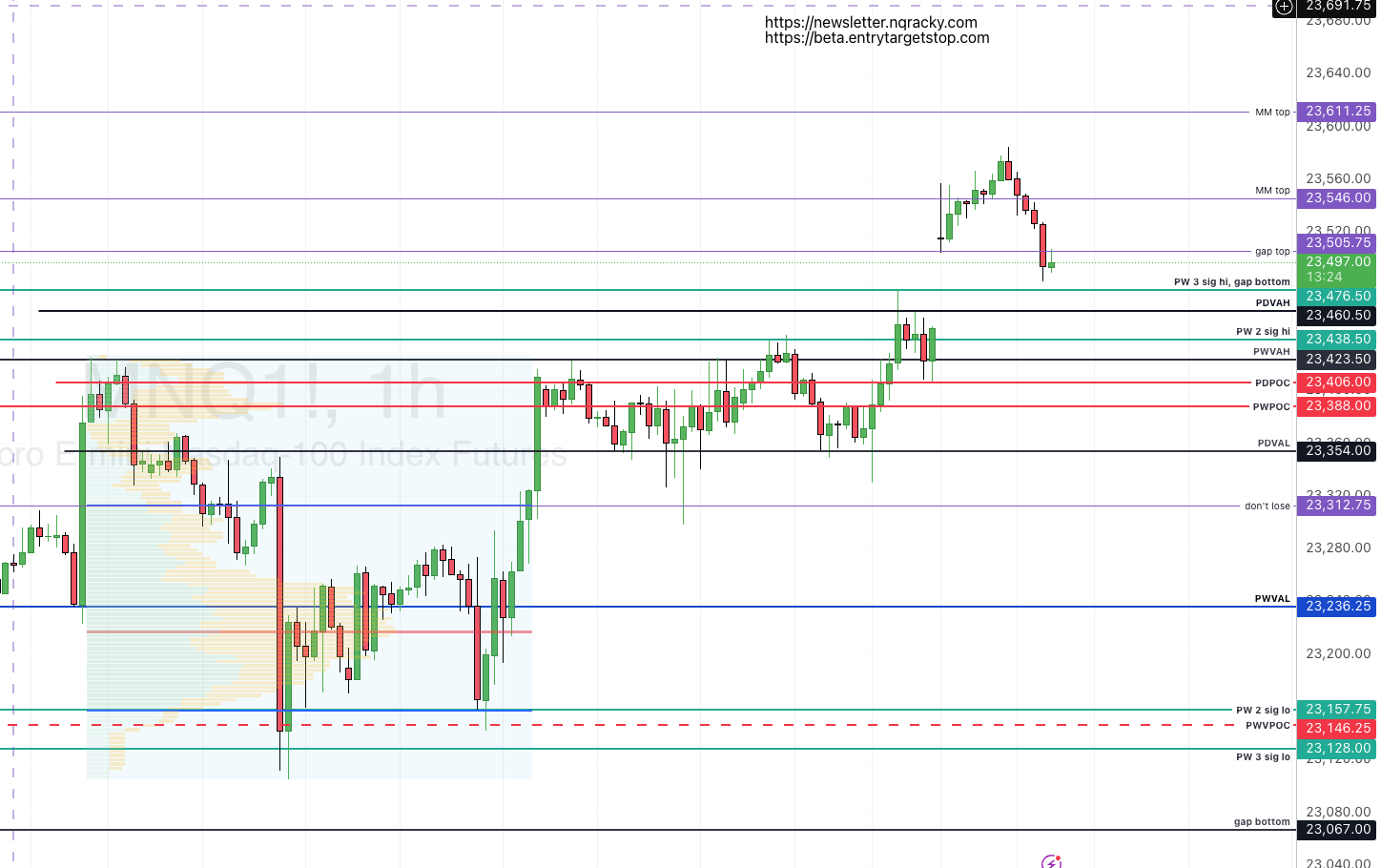

Above staying above 23423.5 is not likely for the en tire week, but anything can happen. If so, expect them to either range above reaching to 23611.25 and perhaps higher | Below There’s always plenty of room to fall, starting with a loss of 23460.5 (friday’s value area high), and through the sigs: 23476.5 → 23438.5 into last week’s value area starting at 23423.5. if we see them closing candles below, 23388 is open, which opens the door to 23236.25 as they try to call it a crash, until 23146.25 which is a great bounce place. |

📸 The Big Picture

The bulls puffed out their chests to start the week with a gap up! With all of the impending news, that’s lots of room to make some money on the way down, if they so choose.

That said, as expected, the overnight activity is cooling down, and they’re toying with a loss of the gap top. A close of the gap is possible before or during the open, and she can go higher, but longer term i am not incredibly interested in shorting the tape with size, save for scalps at key levels (see “below” numbers above). The trend is your friend, and so far, the overall trend is up, so bounces are what are being looked at, at least to start off the week. long with smaller size off of the weekly highs, maybe a scalp at last week’s POC (23388), but there is a multi-day balance area whose POC looks more palatable at 23313 ish for a long, potentially back up to new all time highs.

Lots of news this week, so be careful to lose as little as possible, as they whip around the tape. a decent rule of thumb is major levels only, test positions, add on to winners.

📰 News

Date | Time | Description |

|---|---|---|

7/29/2025 | 10:00:00 AM | US JOLTs Job Openings |

7/30/2025 | 8:30:00 AM | US GDP Growth Rate QoQ Adv |

7/30/2025 | 2:00:00 PM | US Fed Interest Rate Decision |

7/30/2025 | 2:30:00 PM | US Fed Press Conference |

7/31/2025 | 8:30:00 AM | US Personal Spending MoM |

7/31/2025 | 8:30:00 AM | US Personal Income MoM |

7/31/2025 | 8:30:00 AM | US Core PCE Price Index MoM |

8/1/2025 | 8:30:00 AM | US Non Farm Payrolls |

8/1/2025 | 8:30:00 AM | US Unemployment Rate |

8/1/2025 | 10:00:00 AM | US ISM Manufacturing PMI |

Here’s to patience, learning, and profits!