- NQrack 💉💉💉

- Posts

- 2025.07.30 📈📈📈

2025.07.30 📈📈📈

🌟 Welcome!

🔢 The Numbers

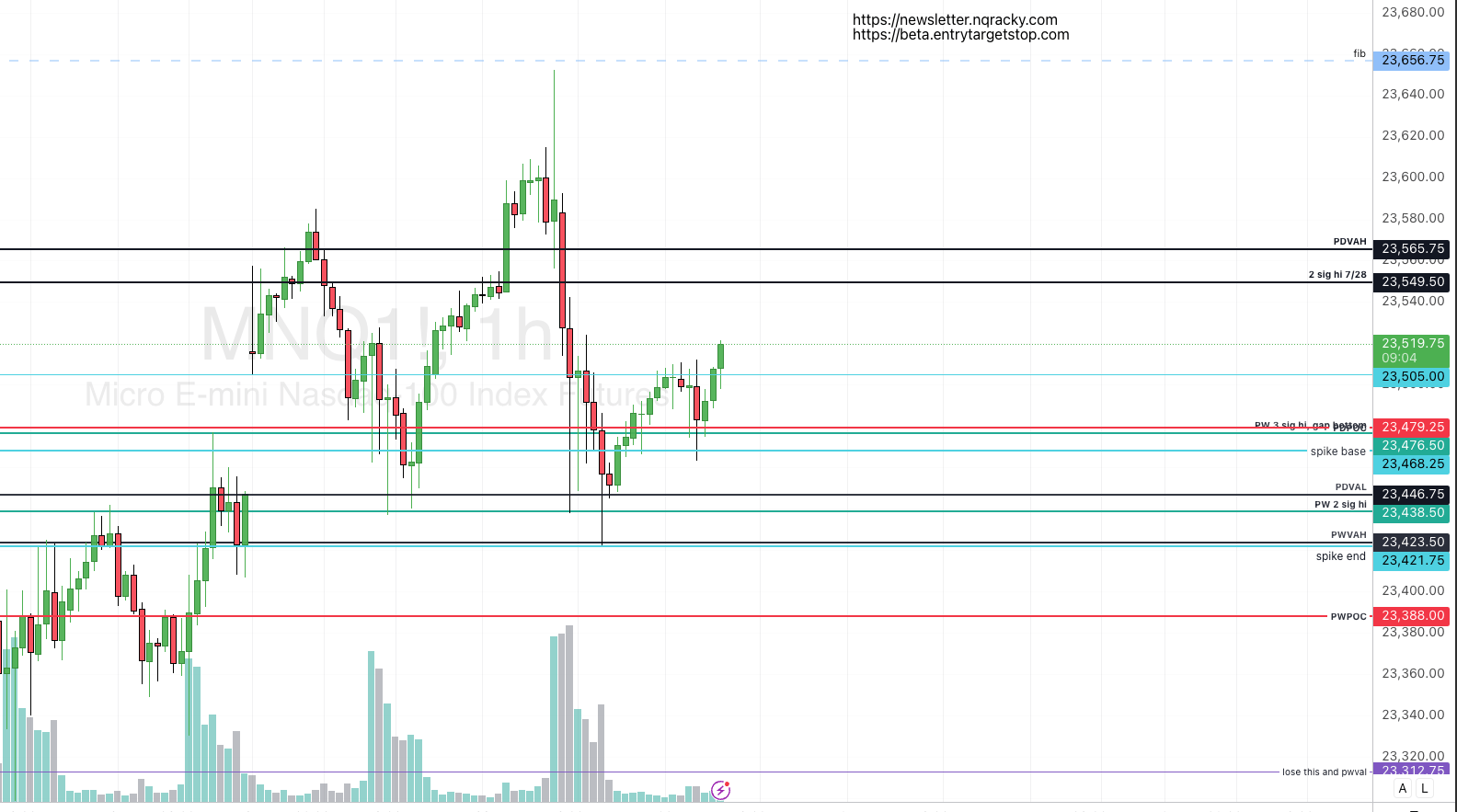

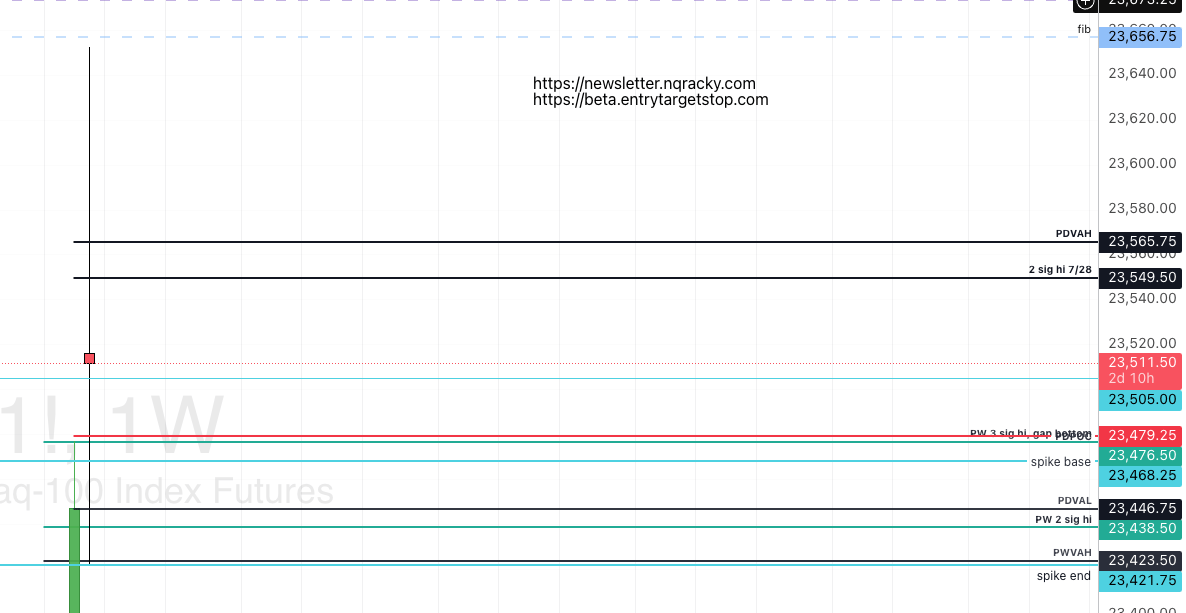

Above stay above 23468.25, and they can make it to 23549.5, then 23565.75. But they’ll have to stay above 23565.75 to be bullish for the day. If so, they can reach our higher targets and new all time highs. | Below staying below 23565.75, and we can lose 23468.25. lose that, and it’s. 23446.75 on the table. losing 23423.5-23421.75 and lower numbers are on the table. |

see the link to my tradingview in yesterday’s newsletter; i’m still updating it this week.

📸 The Big Picture

Bullish creeping higher this morning. But not bullish on the day, yet.

Same story as yesterday. Slowly creeping higher. Having made a new ATH at the start of the session, she tapped near my fib level, retreated, and continued to sell off. That said, she staid above last week’s value area high, so they’re interested in staying bullish for the week, and it’s Wednesday. While they’re interested in it, they are still in the middle of creating a pretty thin doji on the week, and as of today are indecisive, so. anything can happen. Can they turn it up? Or will the news send them retreating to lower numbers today?

I can see them at least trying to retest yesterday’s value area high, but they have a ways to go to get t here, and could get knocked back. News this morning so we have plenty of room to run; keep an eye out.

📰 News

Date | Time | Name |

|---|---|---|

7/30/2025 | 8:30:00 AM | GDP Growth Rate QoQ Adv |

7/30/2025 | 2:00:00 PM | Fed Interest Rate Decision |

7/30/2025 | 2:30:00 PM | Fed Press Conference |

These are all high-impact US economic events happening today. The GDP data comes out in the morning, followed by the Fed's interest rate decision and press conference in the afternoon - which should be particularly significant given the current economic climate.

Here’s to patience, learning, and profits!