- NQrack 💉💉💉

- Posts

- [nqrack] 2025-04-07 what i'm looking at this week

[nqrack] 2025-04-07 what i'm looking at this week

she dumped hard in futures, them futures boys are often wrong, however.

The Numbers

I always find mondays easiest to trade, and in spite of their dump, this is no exception. In fact it’s made easier because the dump, because they’ve now been transacting in a zone. 🙂 I’ll give you these, and see if they are already completed by the time i finish typing the newsletter, haha.

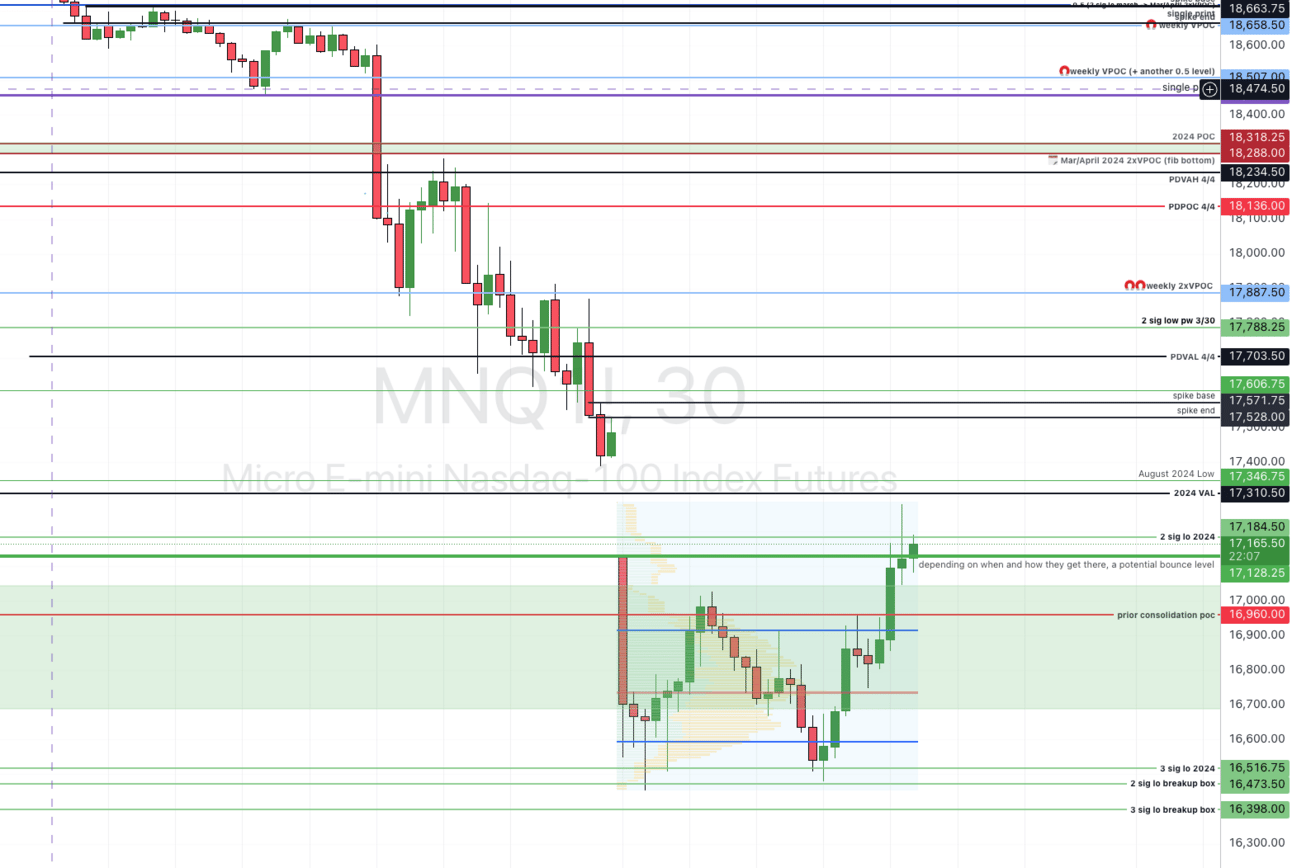

staying above 17128, 17184 opens the door to 17315.50 (2024. VAL)

staying above 17315.50 opens the door to 17346, which opens up 17528, 17703

losing 17128 opens back up 17042.25, 16960, and losing that, the lower end at. 16700, and our 16516.75, 16473.54, 16398, and below.

I’m worked on a tool this weekend that will hopefully quickly help me get some QQQ equivalents (or close) in the list above. Needs some tweaking, hopefully can get some QQQ numbers on the board as well here, soon!

The Big Picture

We are in a downtrend (ya think?), but most importantly, we are looking for balance. Markets move from balance to imbalance. How? by Trend → Break → Balance. We have been steadily trending down since Wednesday and haven’t found “our spot” yet, so proceed with caution. We could have a V. shaped recovery, we certainly have more numbers below (I honestly hoped, thought, the August lows would provide our bounce, but they’re serious about this selloff), but until they’ve established a balance, I gotta be cautious.

let’s talk about this important number. This fine number, that i was looking to play for a beautiful long, depending on how they got there:

Can’t remember when I had it there, but was looking forward to playing it Monday…The scoundrels opened DIRECTLY UNDER my “potential bounce level” and took a major dump at session open Sunday. well played. I wasn’t the only one looking. And the bears weren’t letting us have it for anything. They made me do my homework, because to be honest I hadn’t gotten any numbers ready below. Thankfully the market has a memory. I used a previous consolidation area from December 2023 and apparently the market did as well. They’re good levels to watch for, and they were able to work their way out of it, bouncing at some expected levels below (2 sig low of the breakup box).

My hope is that this marks the beginning of a balance period, at the least, So it. won’t be such a pain in the butt to find some new numbers down these parts, but I’m not quite sure we’re done with the selling, so I’ll remain vigilant. Some people are screaming FIRE! some are screaming FIRE SALE! I will say this, if you’re building a position long term, it certainly isn’t the worst place to buy, given we’re at last year’s lows…just don’t freak if we go lower.

Given they have been giving us new numbers pretty quickly these days ,I’ll share this week’s chart, and I’ll try to keep this one updated this week as much as possible as we move through it.

https://www.tradingview.com/chart/bdOWFV3S/

News on Deck

Some significant news on deck this week, so be aware:

4/9/2025, 2:00:00 PM | US | FOMC Minutes | |

4/10/2025, 8:30:00 AM | US | Inflation Rate MoM | |

4/10/2025, 8:30:00 AM | US | Core Inflation Rate YoY | |

4/10/2025, 8:30:00 AM | US | Core Inflation Rate MoM | |

4/10/2025, 8:30:00 AM | US | Inflation Rate YoY | |

4/11/2025, 8:30:00 AM | US | PPI MoM | |

4/11/2025, 10:00:00 AM | US | Michigan Consumer Sentiment Prel |

Alrighty that’s all I got. We know that trading is more than knowing the numbers, so hoping, praying y’all can wait for what you’re looking for then pounce!

Here’s to patience, learning, and profits!