- NQrack 💉💉💉

- Posts

- [nqrack] week of 2025-04-27: what i'm looking at. Very Strong week in a weak market. Did we indeed have our bottom?

[nqrack] week of 2025-04-27: what i'm looking at. Very Strong week in a weak market. Did we indeed have our bottom?

she's broken out of a key area, and entered into another. will she hold, or is it all sound and fury?

The Numbers

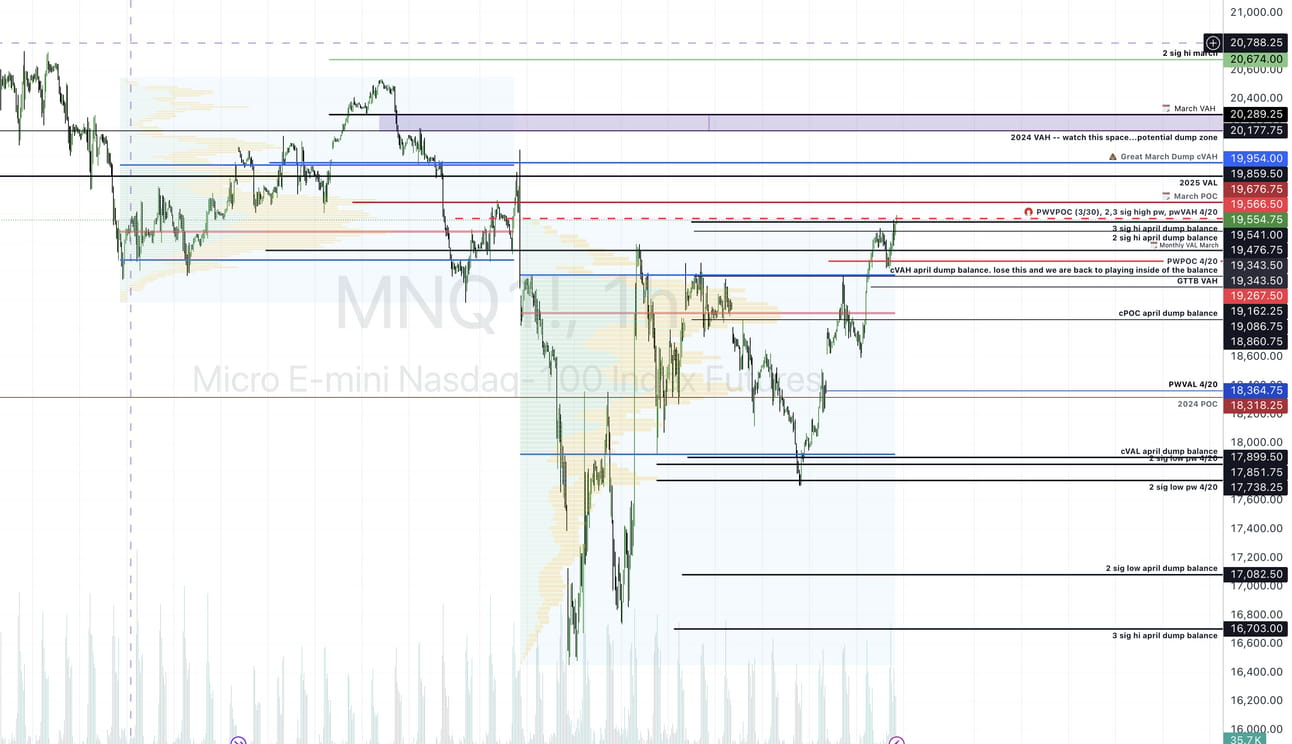

She means business. so let me start with what’s above. And as this is a weekly outlook, i’m trying to be slightly more extended on the numbers front.

Given the current momentum, headed to test 19676.75 if she can make it there, and crack it, it’s opening the door to 19859.5, a critical milesotne, as it’s the value area low of 2025, and opens the door to 19954. 19954 will finally get us back to what we lost on that fateful day in March, and, in my view out of correction territory. A bull can dream about 20289.25, right?

We’ll see if she makes it, as we are at a critical juncture where we can start losing it and continue to play in our current balance area, where 19541, 19476.75, 19343.5, 19267 live. a loss of 19162.25 for any sigificant amount of time most certainly signals that we’re going back to play in negative territory again. I would suspect on the way down to see some bouncing, with stronger defnese around 19267.5, and especially 19162.25. Remember, defense often looks like a spike through, an “almost lose”, then some consolidation before pushing back up. set your stops wide and wise.

The Big Picture

She’s broken out, lots of strength as far as what numbers she’s recovered, and if you let the news tell it, retail is “all in”. And, in spite of what you may hear to the contrary, regardless of why she moves up, price is price…whether those who’ve bid it up are “dumb money” or not.

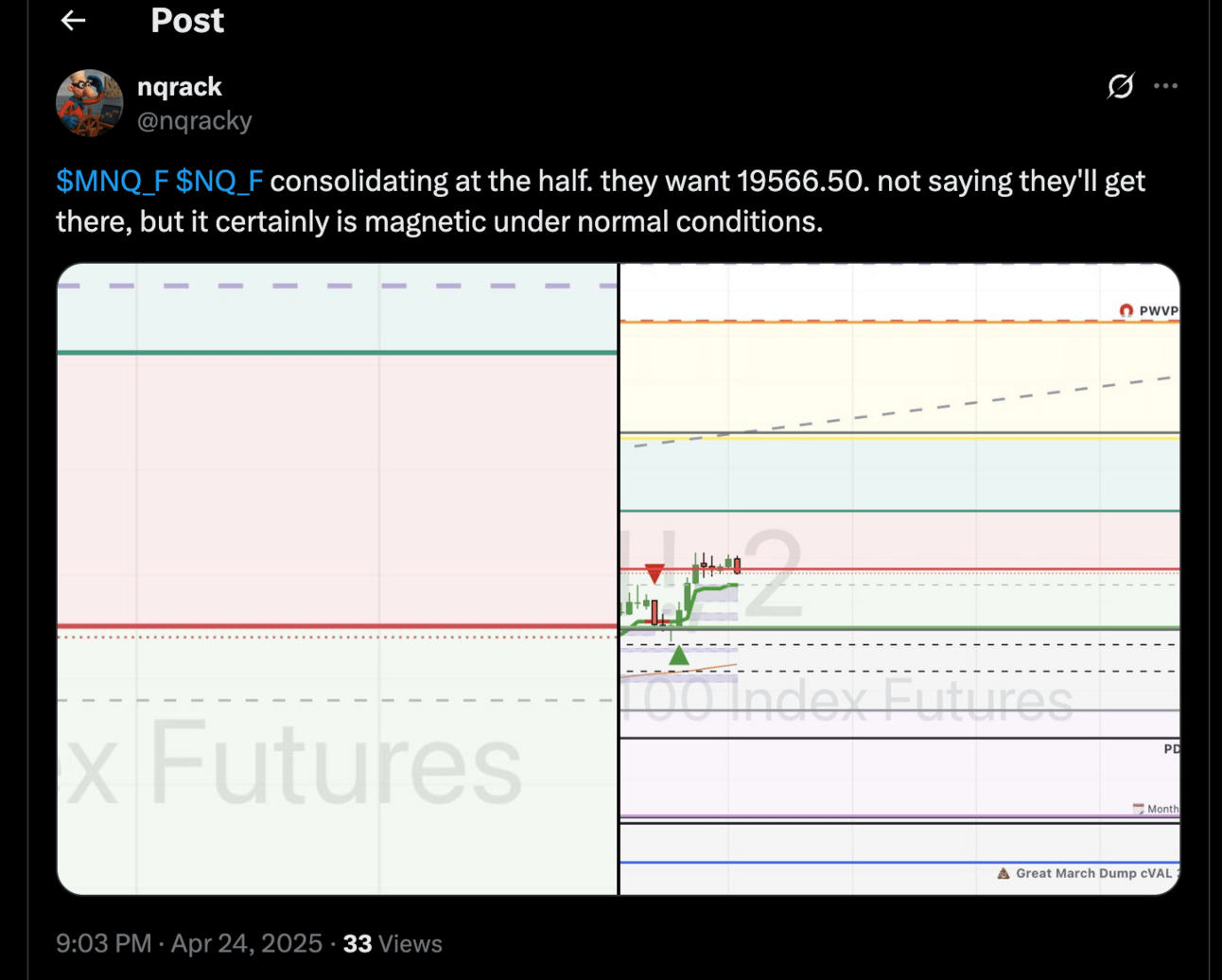

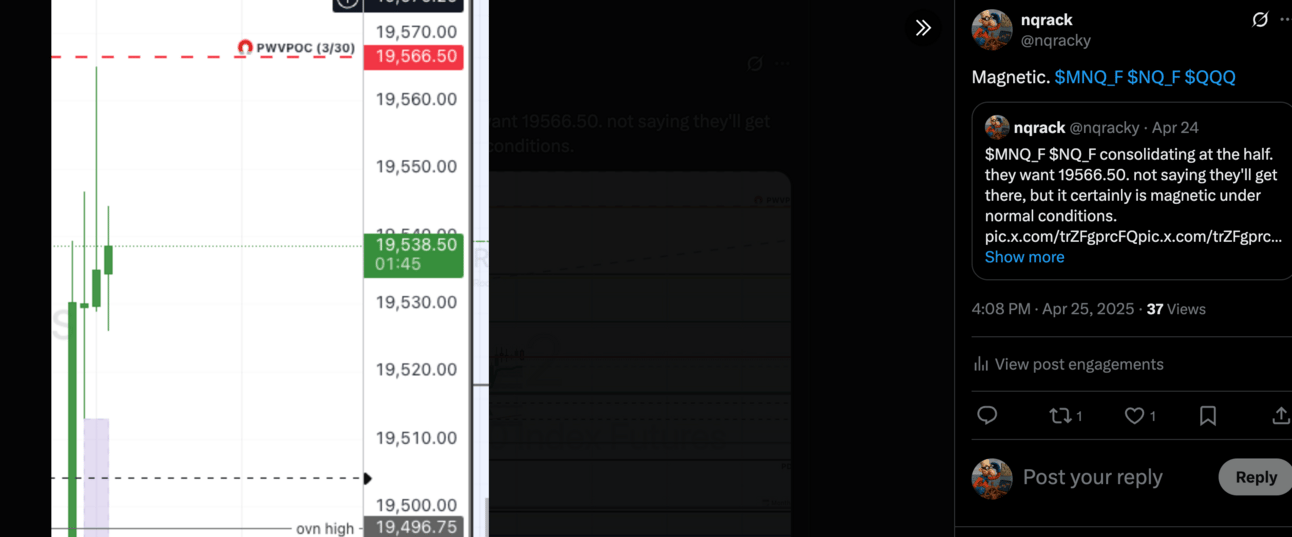

I want to remind you of two key balance areas. We’ve broken out of the lower balance area for all intents and purposes (above our 68% high water mark for volume traded at price), but…and there’s a big but….it was after the bell that we got our 19566 number that i was tweeting about. which, let me take a short commercial break and shout out to volume profile analysis. 19 hours before the deed, yours truly told you that that’s what they were looking for.

right before the bell, we got dang close…and about 10 minutes after the bell, spiked it, as we sold off from there.

Does your mans have a crystal ball? No. Does he speak to soothsayers? God forbid! but does he understand his numbers? We’ll have to say…that’s an affirmative. 😀 The market can play games, but what they cannot do is hide behind volume. These areas are, in this current iteration of the markets (let’s just say decades so far), what they are, and will be, as will participants be.

Now, back to our regularly scheduled week. I gave you the numbers above, and I’ve finished my charting, so here is your gift, below, use it as a guide, and add what you need if necessary:

Note 2024 Value Area High above…while there’s still room to run on the upside, I would be careful around these parts, looking for retest of peeking above and failures, or being okay with being a little late on breakouts, and setting your stops a little larger below the breakout areas. 2024 VAH (20177.75) could be a potential dump zone; maybe a good multi day play…

We are at a critical juncture…Do not be surprised if we have an amazing dump this week, and do not be surprised if we see follow through on the upside, with plenty of bagholders along the way, waiting to either exit their position, short on opportunity, or sell you what they don’t think is worth it, given our overall global economic conditions.

The name of the game is lose as quickly and as little as possible, so you can stay in the game, because, as David Frost would say, you never know which one (trade) will give you the rocket ride. 🚀🚀🚀

Here’s to patience, humility, confidence, learning, and profits! Have a great week. 🫡