- NQrack 💉💉💉

- Posts

- What I'm looking at this week

What I'm looking at this week

(M)NQ outlook for the week

The Big Picture

On the week, we didn’t really do much at all. We took at dump on Monday, then, just hung out in a balance. Great for range trading, but certainly frustrating for anyone looking for a continuation or a bottom.

That said there’s a lot of talk about a bottom in all of the media I’ve been taking in; I can’t tell how much is hope or cope. 🙂. Anything can happen, there’s still a bit of room below, as we still haven’t tapped 2024 POC, and the news cycle could help catalyze more of a drops. More on that below. That said, she’s in a place where she could try to power out of that turbulent zone for higher numbers and recapture what was lost, especially given the word on the street that downside interest has been heavy, and a short squeeze (at least of the temporary sort) is eminent.

Zooming in…

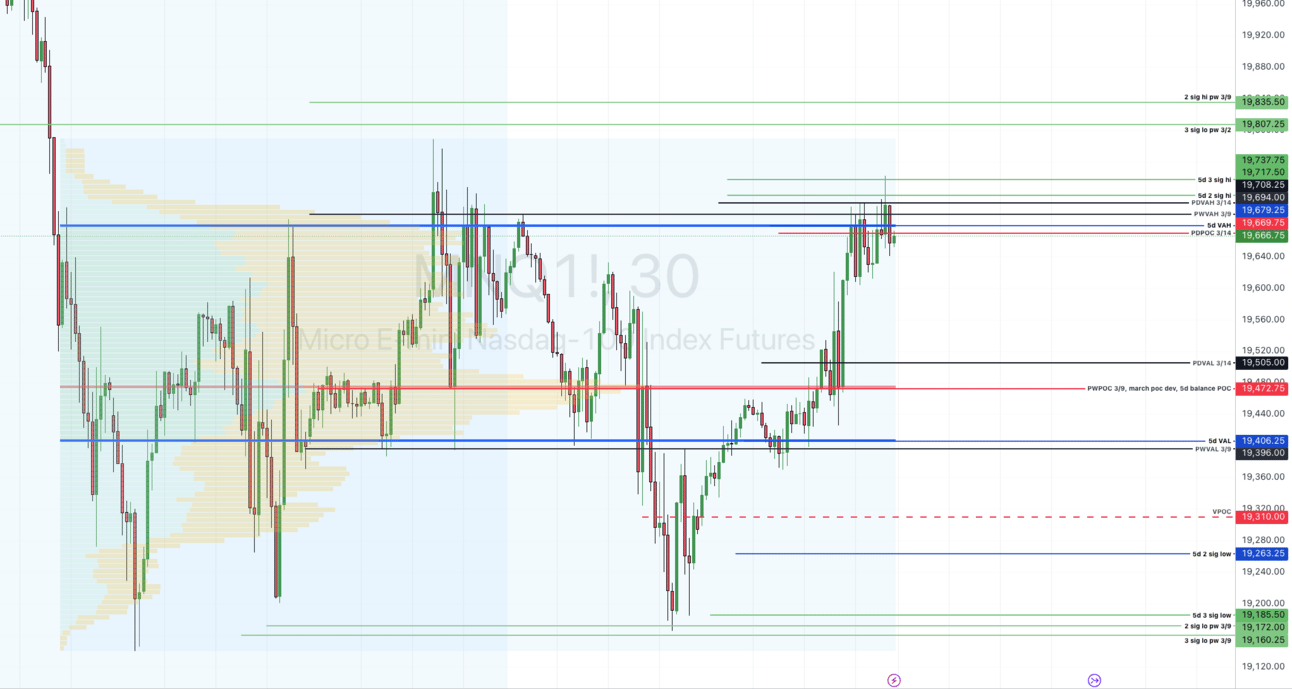

lots of levels to get through before she can get back to anything near what I’d call bullish territory, but she’s in the zone to work it out

If you read Friday’s email, i mentioned the rough waters above, and it’s certainly been a problem. there are a lot of levels to work through in order to even begin to recover what we lost about two weeks ago. One way I can see them getting over it is a gap up at open (update: that didn’t happen), or a quick rout up during the open, however, given we’ve been in a 5 day range, high probability that we begin to seek below, if we can’t get moving quickly above this sticky area. Below the range is still, especially in this correction season, quite a bit of unfinished business to test below, including the still untapped 2024 VAL, 2024 VAL and 2-3 standard deviation below. If she loses PD value area low, we’re on our way to the bottom of the range, and (hopefully for my personal sanity) finally tapping 2024 POC (because i’m tired of talking about it 😂 )

Looking Forward

There are some strong levels of support below, especially here @ 17984. Look at the 3 day chart…we have a pretty nice strong level of support below, where, if we were to lose it, I don’t know what to say about our economy. It’s quite a ways away, however, but keeping it in mind so we can be aware of it.

Let’s see how we open the week. As far as each day? I’ll be looking to play the edges again, and follow any trends at proper pullbacks based on order flows and retests at key levels. This political season has given us some significant movements, which is a day trader’s paradise. It’s great to be a barnacle.

This week’s news, with those in bold I think that might move the tape decently out of the balance…

3/17/2025, 8:30:00 AM | US | Retail Sales MoM | |

3/18/2025, 8:30:00 AM | US | Housing Starts | |

3/18/2025, 8:30:00 AM | US | Building Permits Prel | |

3/19/2025, 2:00:00 PM | US | FOMC Economic Projections | |

3/19/2025, 2:00:00 PM | US | Fed Interest Rate Decision | |

3/19/2025, 2:30:00 PM | US | Fed Press Conference | |

3/20/2025, 10:00:00 AM | US | Existing Home Sales |

Let’s see what they do. Here’s to confidence, learning, and profits!