- NQrack 💉💉💉

- Posts

- What I'm looking at this week (2025.03.23)

What I'm looking at this week (2025.03.23)

don't stop to ask...

A Very Special NQracky — an interview! (11:11)

OK, maybe not, but I do want to call attention to something I was able to put together over the weekend, that I hope will be helpful, if you have eleven minutes and eleven seconds. I spent time gathering my notes on the particular flavor of price action trading I do (Volume Price Analysis), took in some of the newsletters and tweets to help tie together the power of VPA in understanding the market. You can hide intent with candles, but cannot hide the numbers happening on the tape (nevermind those pesky Dark Pools ;-) I’m having issues presenting it on the site, so forgive me, and allow me, to share it here in the newsletter:

This week - The Beginning of a Bonafide Breakout? Or a Gap & Crap?

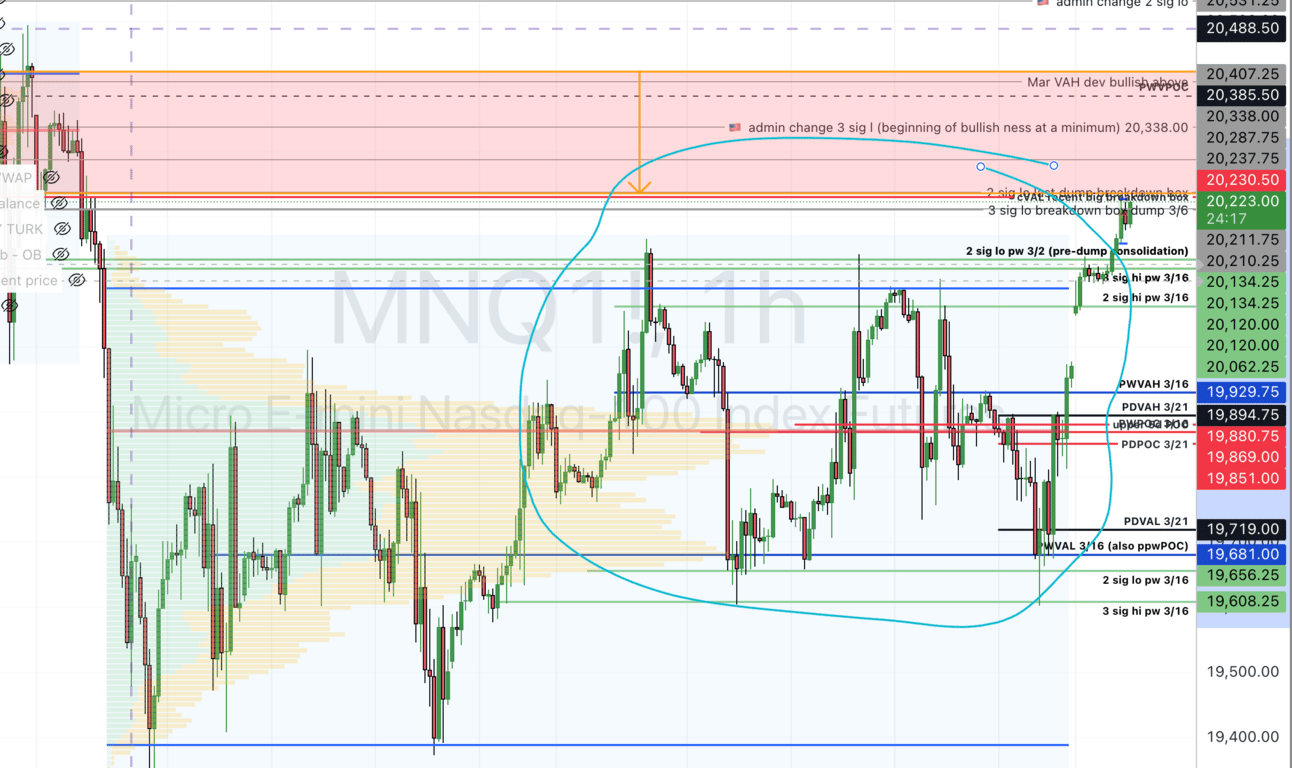

We have a somewhat expected gap up to start the week…sometimes that’s the only way they can start getting past some numbers they need to! So kudos. I took small shorts overnight and made a little profit, but she was intent on running it up, and take a look, she finally made it past the 3 sigma hi of our multi day balance area, with vigor:

It was solid enough of a pump for me to take a few scalps before the day began on the way up, and now done for the day, personally! Good thing for me, as they are certainly feeling spicy, and i’m not trying to get caught up in the heat this morning. They need to leave something for the daytime traders, sheesh!

As of this writing, they are pushing right up into a critical area, creeping, accumulating, creeping, accumulating….and they appear to be trying to work their way through the big dump two weeks ago (I’m still writing this, so update: yes they are, they are in it now). They’re coming up to some critical areas, which we’ll call the breakdown value area (BVA, what’s another acronym). I’ve drawn the range of that area, and it’s interesting, in that the POC of that area happens to be the beginning of my “actually bullish” area. Note that in my experience, we have a decent initial rejection of that POC area under normal conditions, but they need to get into that red area first to even get started with the attack. expect some battling, or at the least some volatility and messiness as they fight through that area, but an initial rejection is not unexpected, especially after tapping 20338.

In fact, they have plenty of room to reject that red area, close the gap below, as they try to work back up (That’s a lotta points for a day trader). Why is that? They’ve created another “upper balance area” last week, take a look:

If they want lower than the above balance area (i.e. continuance of this larger down trend), they’ll need to first start to lose numbers down that way. On the face, it doesn’t look like they want to head there again just yet. The biggest tell will be if today is a gap and crap. If they peek above and fail the red area above, i’m expecting a try to close the gap. And, they can’t close the day above the gap today, the overall multi day balance is certainly on the table again.

Outlook and plan

It would seem that they’re going to try to recover fully out of this dump balance this week (it’d be a great time to do so), however, we could trade in this range for quite some time, still, especially if they reject our “red area”. They could and continue working in that upper balance area until they get the energy to push through, or fail altogether, lose it, and go for a break down of this area. If they can close and stay above 20338, then, then we may just be looking at a bonafide bull party this week! News last week seemed to have a significant effect, and it doesn’t seem like there’s participation from any large players (yet), in spite of so many calling the bottom. But we are still floating upwards, so anything can happen.

News This week, with my picks in bold for the potential market movers:

3/26/2025, 8:30:00 AM | US | Durable Goods Orders MoM |

3/27/2025, 8:30:00 AM | US | GDP Growth Rate QoQ Final |

3/28/2025, 8:30:00 AM | US | Personal Income MoM |

3/28/2025, 8:30:00 AM | US | Personal Spending MoM |

3/28/2025, 8:30:00 AM | US | Core PCE Price Index MoM |

Here’s to learning, confidence, and profits!

And for the young souls who may not get the thumbnail image (and caption) reference:

https://www.youtube.com/watch?v=IIOJdMdS56k