- NQrack 💉💉💉

- Posts

- what i'm looking at this week 2025-09-07

what i'm looking at this week 2025-09-07

still bullish until she's not

🌟 Welcome!

📸 The Big Picture

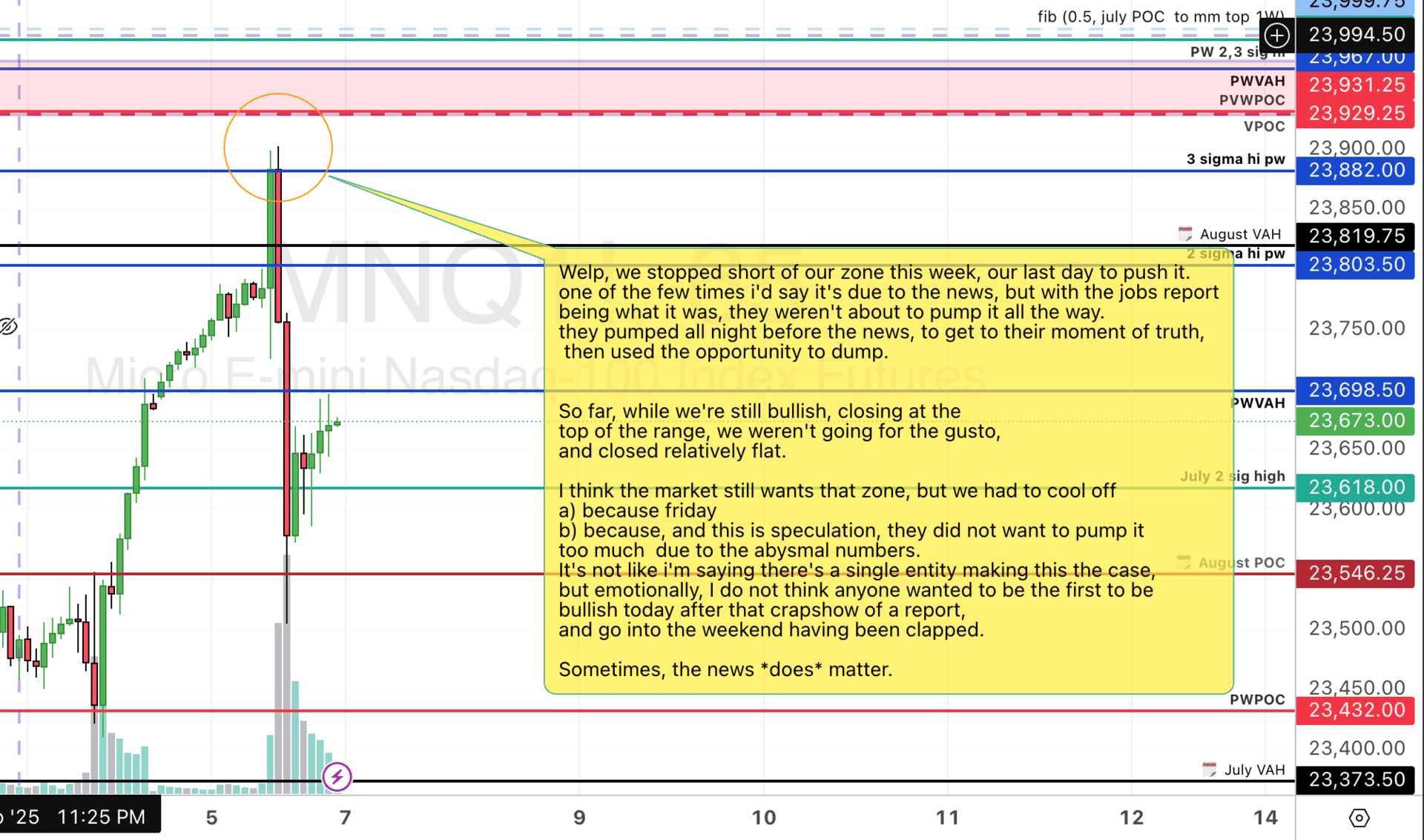

We stopped short of what I thought should be a high target, and certainly a magnetic number, but didn’t make it. But we’re still bullish.

Friday would have been the chance they had to push the price up to our VPOC numbers…which are normally magnetic, especially with a Previous weekly VPOC being on the horizon, and the fact they finally waited ‘til the end of the week to push it, breaking the high of last week’s value area.The fact that it stopped short while so close was interesting to me. This really makes this one of the few times i'd say it's due to the news, given they had a chance to push it there (and beyond), but upon the news made a retreat.

So far, while we're still bullish, closing at the top of the range, Friday they didn’t go for the gusto, and closed relatively flat for the day. Note that she closed right at the high of the weekly range.

I think the market still wants higher, wants that zone, but we had to cool off a) because it was the last day of the week b) this is speculation, they did not want to pump it too much due to the abysmal jobs numbers.

A point of order — It's not like i'm saying that the market is a single entity or algorithm that decided to pull back. I don’t subscribe to the market as some kind aof “algorithm”. I’m talking about, as an aggregate, I do not think traders wanted to be the first to be bullish today after that 💩 of a report, and go into the weekend with losses.

Sometimes, the news does matter.

of note…

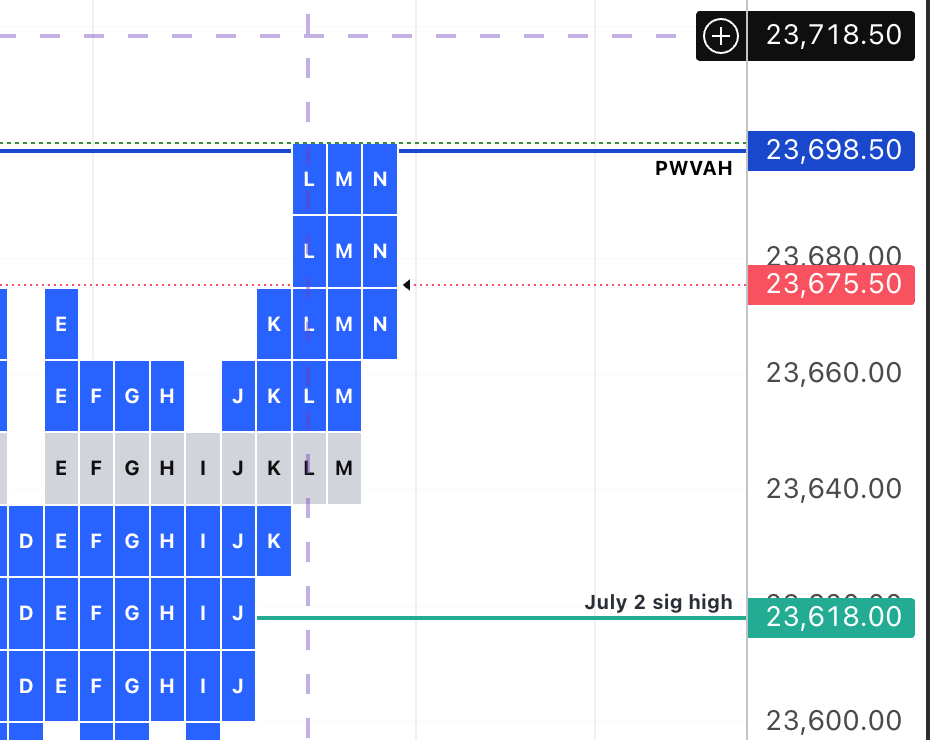

PWVAH is at a poor high. Interesting. if we trade lower overnight, i’m looking for them to try to clean that up at the open, unless they’re dropping below last week’s lows, but otherwise, as long as they’re still hovering within last week’s value area, i’m looking for bounces to travel upwards to try to clean up this poor high. Note that it’s possible for them to just gap above all that and continue highter for the week.

So, if we gap up, keep an eye on whether or not they make it to the zone overnight, or stop short before the open up in the higher range. If they trade lower during the evening, i’m watching to see if she stays above 23432.

I see a week where MNQ could finally reach it’s all time highs during market session, then dip below as much as they want, or, continue even higher. It’s anybody’s game, and anything can happen.

Below is my chart; I’ll keep it updated during the week.

📰 News This week

There is quite a few of news that can move this week, so i’m expecting a good bit of volatility this week…great for trading!

Date | Time | Description |

|---|---|---|

Tuesday, 9/9/2025 | 10:00:00 AM | US Non Farm Payrolls Annual Revision |

Wednesday, 9/10/2025 | 8:30:00 AM | US PPI MoM |

Thursday, 9/11/2025 | 8:30:00 AM | US Core Inflation Rate MoM |

Thursday, 9/11/2025 | 8:30:00 AM | US Core Inflation Rate YoY |

Thursday, 9/11/2025 | 8:30:00 AM | US Inflation Rate YoY |

Thursday, 9/11/2025 | 8:30:00 AM | US Inflation Rate MoM |

Friday, 9/12/2025 | 10:00:00 AM | US Michigan Consumer Sentiment Prel |

Here’s to patience, learning, and profits!