- NQrack 💉💉💉

- Posts

- what i'm looking at this week 2025.10.12

what i'm looking at this week 2025.10.12

hold on to yer butts.

🌟 Welcome!

welp, she finally broke. An absolute MASSIVE dump. Especially for what is usually a quiet Friday.

Will we see follow through this week? it’s certainly likely. But let’s take a look at all possibilities for the week.

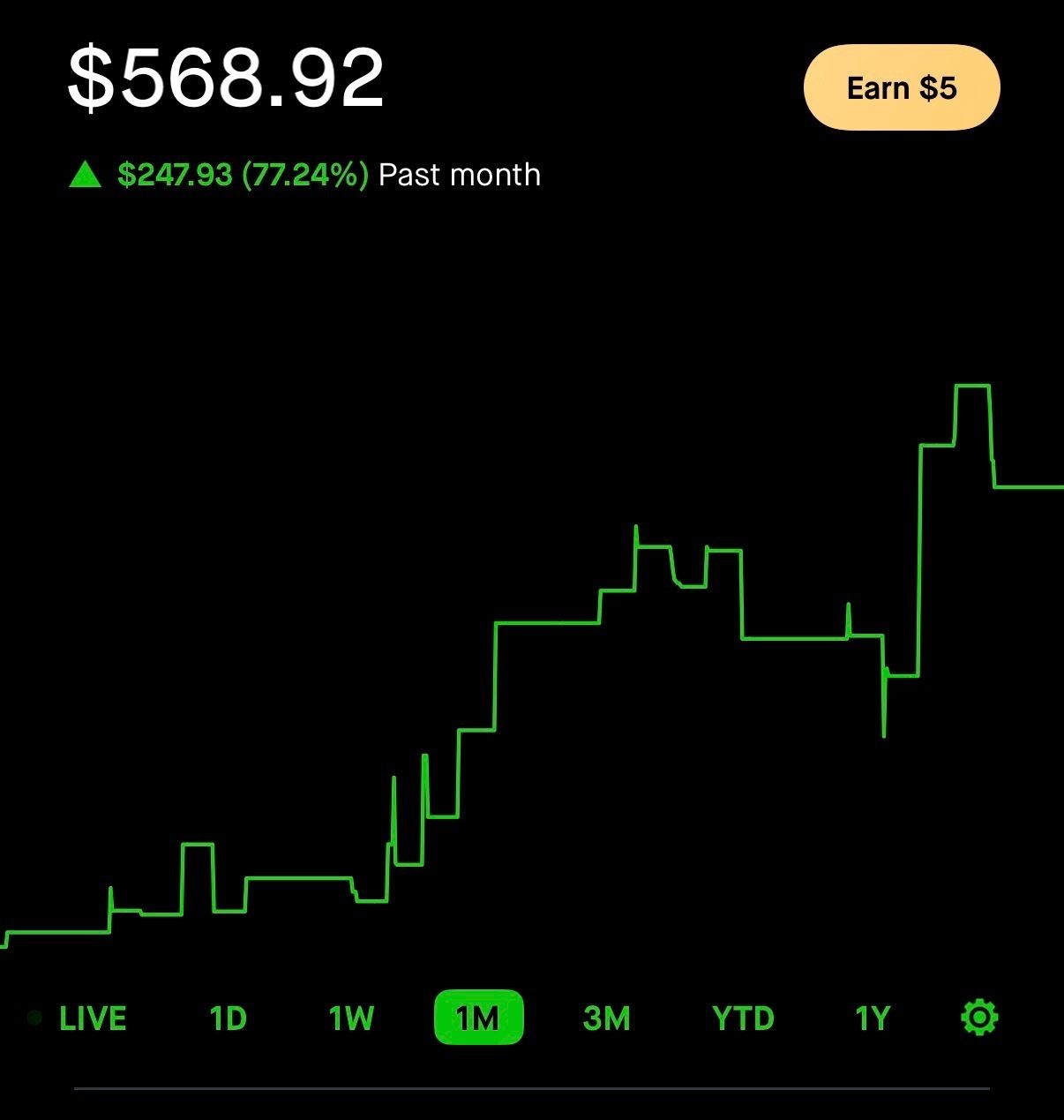

On a trading note — let me tell you about the trade that will haunt me. i am working on a tiny Robinhood account. Started ‘round $300 when i decided to take it up again. Up $250 the past month though, practicing options, keeping risk tight. Can i tell you that I was in a QQQ put, got stopped out at $18 Friday, and because it’s Friday just stopped looking for the day (have made it a soft rule to be extra careful Fridays). During lunch I checked back in…that same put had run up to ~$990. I bawled inside. On the flip side, I respected my risk and remained green for the week. But bruh. I could have afforded the extra $18 to just wait. That’s what a poor entry will get you on a volatile day.

On an administrative note — my day job is taking up a bit of my time these days (and i’m loving it, thanks for asking 🙂 ) — but getting the newsletter out daily is a challenge, and trying to get a handle on automating things as much as possible, so yeah still working on it, and apologies…none of these movements are surprises, numbers wise.

📸 The Big Picture

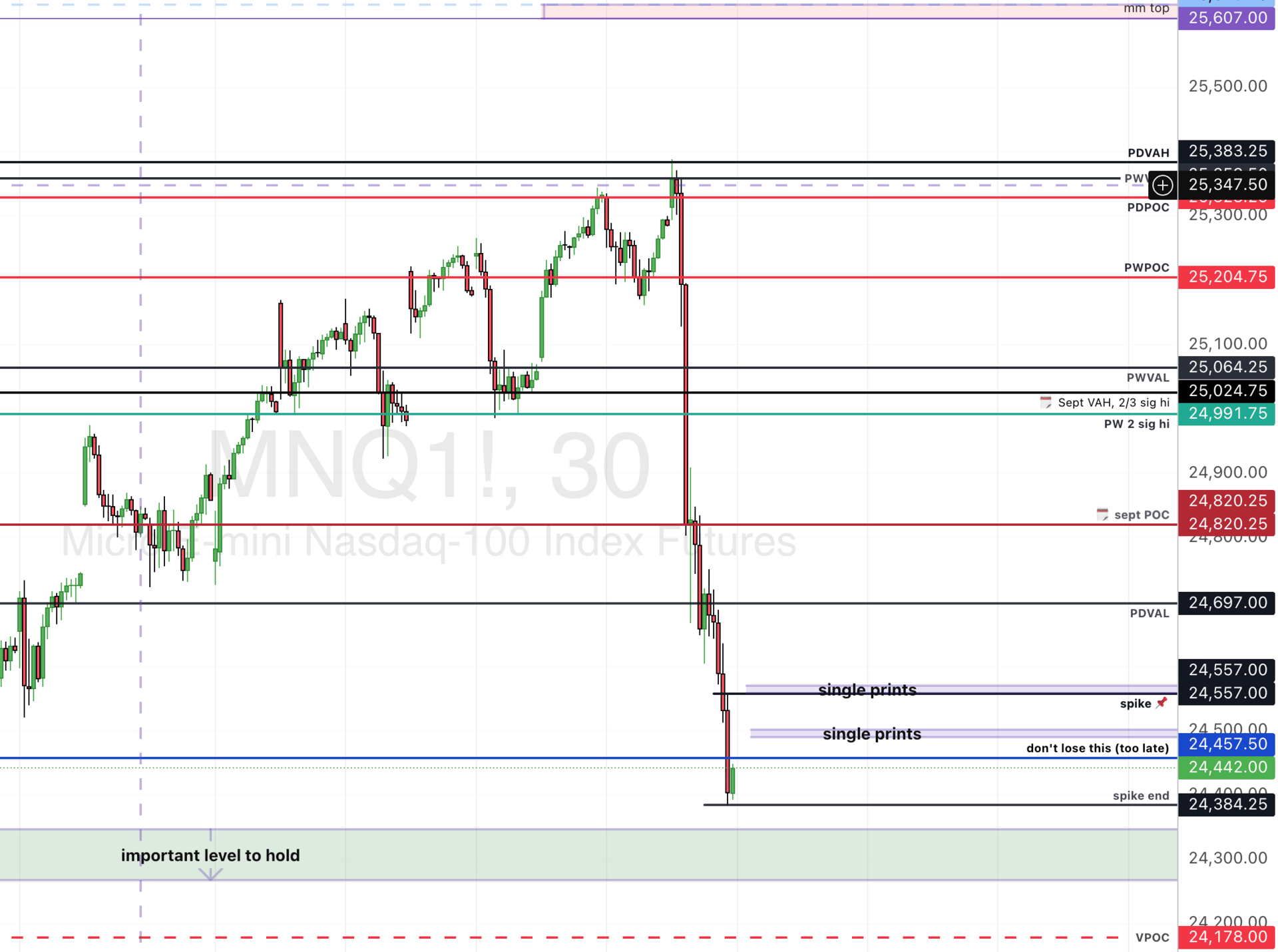

staying inside the spike is hopeful news for bulls.

All poor lows were cleaned up, with prejudice. Early in the week i was upset that they came to them and rebounded yet again. They finished that ish off with ease Friday. This is...one of these times where the news mattered, bigly. See below: we tore through our "Don't lose this" level…

Then consolidated a tiny bit, but did not recover, but shooting down even further in our “little h” pattern. Then, they did one of the dirtiest deeds of all. Nearly an hour after NY session close, she sharply broke below what previously, for me at least, had been a “full stack long” level. Liquidated below three key levels. halting at a long awaited VPOC.

Overall, I don't think that this was an expected dump for the day--the tariff news really set things off. Now, their destination? I'm certain it was part of the plan. We just got there far earlier than we thought we would.

The only good pieces of news are, 1) my numbers don’t lie 😀 , 2) they've left plenty of levels to play with, again, as we are now no longer in uncharted territory, but at known levels. We need only to watch and see where she’s trying to go, and follow suit.

It's an easy ride down to sepember VAL, but if they decide to try to recover, they'll need to recover the spike at 24557, but best believe they have their work cut out for them.

Under normal conditions, with a dump like this, and especially with the after hours action, moving even lower is not unheard of. They love to ricochet from key levels, however, and it remains to be seen if that VPOC will over enough of a rebound for them to recover the green area above. If they can recover, and close say, hourly candles above the green, then traveling back up to gain what they lost Friday might be on the table, especially given there is relatively heavier news this week (which also means they could dump ‘em nicely as well).

Looking forward to see how they open the session sunday, and how Monday’s bank holiday-usually slower trading day pans out. Markets are open…we will see

📰 News This week

Lotsa news to pay attention to this week, that will move markets. Hold on to your butts.

Date | Day | Time | Country | Event |

|---|---|---|---|---|

10/14/2025 | Tuesday | 12:20 PM | US | Fed Chair Powell Speech |

10/15/2025 | Wednesday | 8:30 AM | US | Core Inflation Rate YoY |

10/15/2025 | Wednesday | 8:30 AM | US | Core Inflation Rate MoM |

10/15/2025 | Wednesday | 8:30 AM | US | Inflation Rate MoM |

10/15/2025 | Wednesday | 8:30 AM | US | Inflation Rate YoY |

10/16/2025 | Thursday | 8:30 AM | US | PPI MoM |

Here’s to patience, learning, and profits!

And, here is my accountability pic for the week. LOL.